About Phi Research

Phi "fee" Research publishes high-quality, independent and impartial financial research.

Our core area of focus is in Canadian Small-Mid cap corporations, however our philosophy does not provide any restraints for the scope of our work.

In contrast to institutional research, Phi offers a product that is not based upon promotion, but rather upon quality ideas that are worth sharing. We are funded by our own investment decisions, leaving no room for bias or the encroachment of external agendas.

Investment Philosophy

We view a quality investment thesis as one which combats the status quo. The greatest investments are those which others did not initially share your perspective on. Our goal is to find companies who are either greatly underappreciated or overvalued and to create a strong thesis surrounding their future share performance. A position will only be closed after a set of events leaves our thesis void, or once the market reflects our perspectives in share prices.

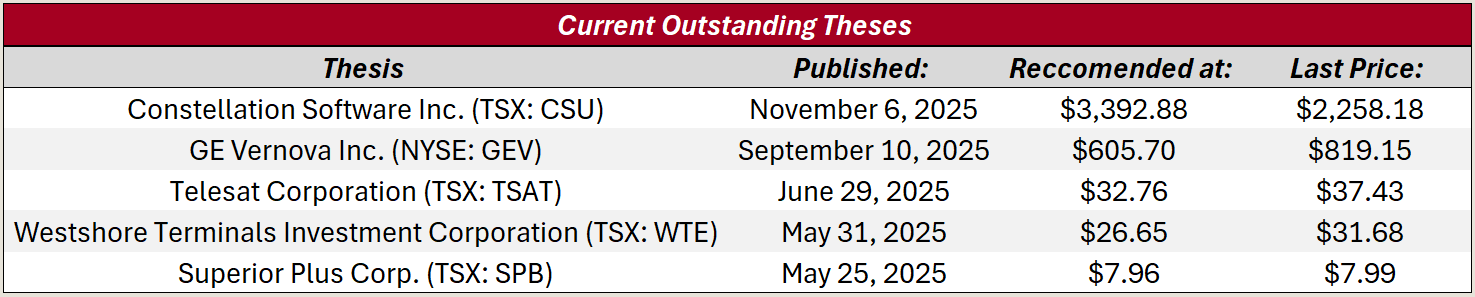

Phi is not a proponent of highly diversified portfolios. We believe that the best protection against risk comes from the rigorous analysis of your investments, not from the disbursement of funds across an excessive number of low-conviction ideas. As a result, we follow a private equity style of investing in the public markets, with five current outstanding theses.

*Prices as of February 17th, 2026 (includes distributions received)

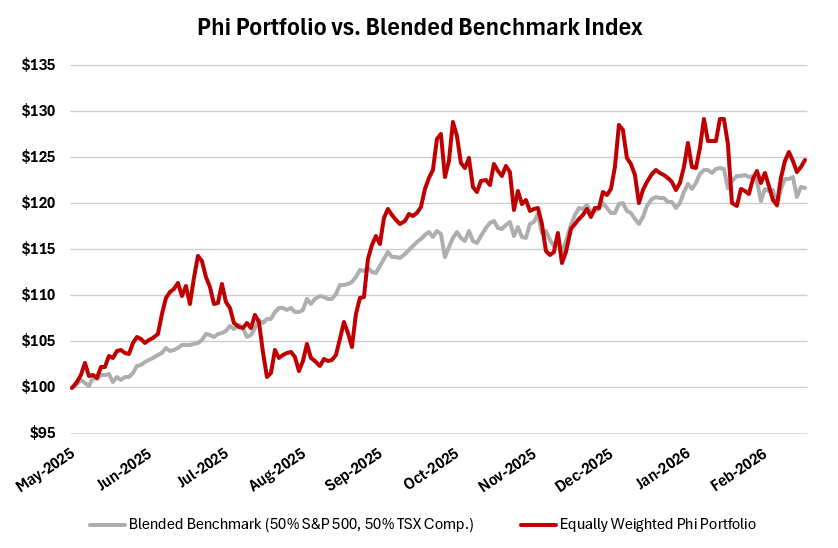

Past Performance

The figure found below shows the past performance of our proxy portfolio assuming an initial investment of $100.00 CAD. Our index is equally weighted and readjusted at the beginning of every month, or on the date of the addition or withdrawal of an investment thesis. As we invest in both Canadian and American equities, our benchmark index is weighted 50% in the S&P 500 and 50% in the TSX Composite. Note that both indexes shown are in Canadian dollars and assume the constant reinvestment of dividends.