Constellation Software Inc. (TSX: CSU), Mapping the Starry Sky

Published on 2025-11-06

Constellation Software Inc. has been building, managing, and acquiring a broad range of Vertical Market Software (VMS) platforms for decades with a high degree of success. Fear surrounding a decrease in profitability or strategic standing of the business due to the development of Artificial Intelligence has recently sent the price of CSU shares into a plunge. We believe this presents investors with an attractive entrance opportunity into one of Canada’s greatest capital allocators, taking advantage of paranoia and misunderstanding in the market.

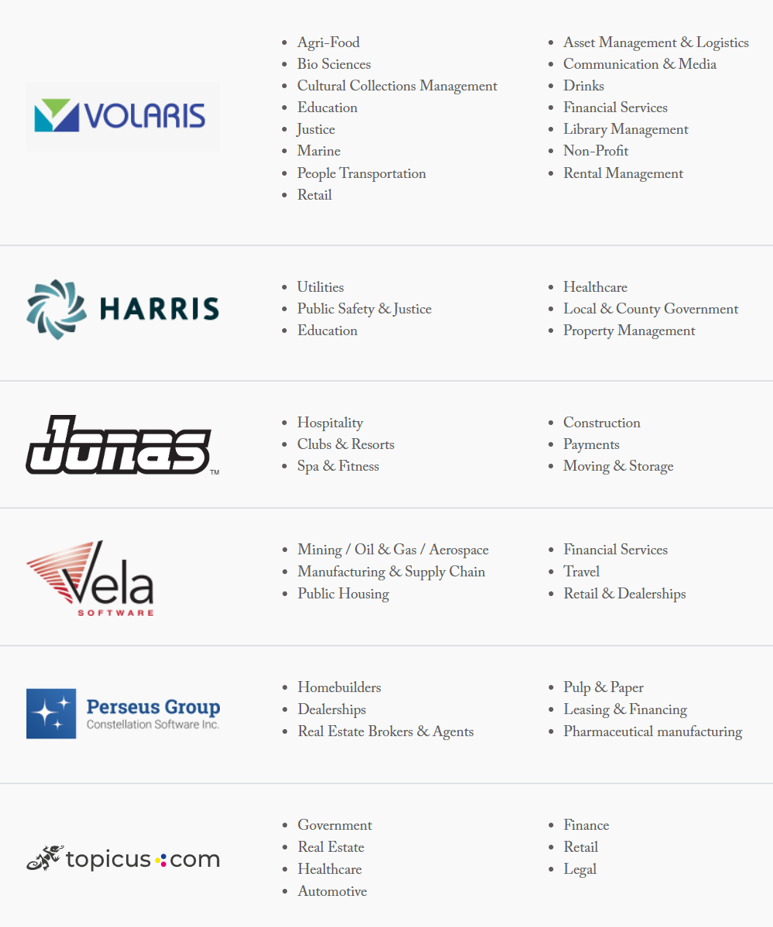

Constellation’s VMS solutions are offered in over 150 unique vertical markets, as per the company’s most recent AIF. As the name implies, VMS products are specialized software products which serve the needs of a specific vertical market such as ride-sharing, radiology, utilities, insurers, pharmacies, credit unions, laundromats, dental offices, or golf courses to name a few. Figure 1 shows Constellation’s six operating groups and a sample of the verticals which they serve:

Figure 1: Constellation’s Vertical Markets and Operating Groups

Source: Company Website

VMS is significantly more specialized than Horizontal Market Software or HMS products (think Microsoft Excel, Microsoft Word, or Adobe Acrobat) which are designed to fit a broad set of needs in a broad set of markets. In general, small businesses will only be able to afford access to these products, however as they grow, at a certain size it will become cost effective to employ the use of VMS. On the other hand, when a business becomes exceptionally large (think revenue exceeding $1-$10 billion), it may become cost effective to graduate from “renting” VMS and move towards a company specific, customized platform from a provider like Oracle or Salesforce. The result of this cycle is a highly predictable inflow of small businesses graduating to medium sized businesses which will demand VMS services from Constellation, and a highly predictable and low risk (although different in every vertical) rate of attrition as companies grow large enough to employ customized systems.

The number of verticals which VMS is now offered in, as well as the degree of specialization in said verticals, has been expanding rapidly over the past few decades. The efficiency with which software can be constructed and managed has grown greatly with technological advancements, which has enabled the expansion of the addressable market for VMS and will continue to do so for the foreseeable future. This, along with Constellation’s exceptional acquisition strategy, has allowed the corporation to grow annual revenues from ~$165M around its 2006 IPO to over $10B in 2024 while also improving profitability.

CSU’s acquisition strategy involves two kinds of acquisitions: deals that break into a new vertical and tuck-in acquisitions within an established vertical. When entering a new vertical, the company will acquire a service provider who is either a market leader in a given vertical, or who CSU management believes could feasibly be converted into a market leader. Once CSU has established itself within said vertical, the company will find tuck-in acquisitions to add on to their leading position in the market. Both styles of acquisitions benefit from the same three kinds of synergies. The first is corporate G&A costs; sharing HR, finance, and other corporate capabilities can improve margins significantly for an acquired entity. The second is a lower cost of financing on the acquired assets; CSU has access to inexpensive and plentiful financing and benefits from having a hand in a highly diverse set of end markets. Lastly, acquired companies are subject to optimization and significant efficiency gains under the management of CSU’s expert staff. Constellation is able to take an acquired piece of software, optimize the code, and then expand its reach with their contacts and sales system. It is a highly effective and proven playbook, and has been both the main use of capital and the main driver of exceptional growth for CSU since their inception. Constellation’s main competitive advantage with respect to acquisitive growth is their human capital, in that their staff’s ability to “fix up” acquisition targets is their main driver of synergy creation. Constellation’s standing at the top of the VMS food chain has until recently been uncontested and their continuing exceptional financial performance has rarely been brought into question.

Polanyi’s Paradox and the Artificial Intelligence Revolution

Although Constellation’s competitive advantage in the traditional VMS space is robust and undisputable, fear has shot through the market for CSU shares in accordance with the development of Artificial Intelligence. Investors have started to believe that, among other things, Artificial Intelligence may replace Constellation’s human capabilities in building and optimizing VMS platforms, and that as a result CSU will begin to lose business to AI hyperscalers as the barriers to building personalized software platforms fall. We will address these concerns, as well as a laundry list of others associated with AI, but we will start with a discussion on augmentation via automation and an important philosophical consideration in the AI space.

Why Are There Still So Many Jobs?

With humanity now facing what is potentially the greatest tool for automating processes (and in an overgeneralized statement of the masses, one which will “take our jobs”), it is interesting to look back on the history of automation and consider why there are still so many jobs in the first place. In the history of humanity, today is likely the day that there have been the most jobs, ever. This is in spite of the fact that the wheel was invented, which would have jeopardized the jobs of people who hauled loads with only their human strength. This is in spite of the telegraph, a device which surely would have put messengers out of business, and the telephone which would have replaced any telegraphers. This is in spite of the printing press, which would have jeopardized the work of script writers. Humanity has developed technology fervently and it has gotten us to today: the day in history where we have the most technology, ever. It is not a coincidence that this is also the day in history where there are the most jobs there have ever been.

The early 1970’s brought the invention of the Automated Teller Machine or "ATM". Prior to their invention (and the invention of online banking, e-transfer, etc.) bank tellers were a busy bunch, mostly counting and retrieving notes and coins for clients. The ATM was designed to do this task exactly, a task which is easily codifiable and thusly is ripe for automation. Thanks to their efficient and low cost nature, between 1995 and 2010 the number of ATM’s in the U.S. economy grew from ~100,000 to ~400,000. A simple assumption would be that bank tellers, the individuals who did the task which the ATM was now perfectly capable of performing, would be put out of a job. In reality, the number of bank tellers in the United States rose from ~500,000 to ~550,000 between 1980 and 2010. Although this is relatively modest job growth for an economy that expanded at a higher rate than 10% over a 30-year period, it demonstrates a very important principle: augmentation. Augmentation is the idea that humans and machines are most effective when working together as compared to alone, and it is the reason why the number of bank tellers did not fall drastically in accordance with the quadrupling of the number of ATM’s in the economy. The reality is that when a technology is created which automates a given task, assuming that an individual who performs this task will have no way of providing value anymore is an extremely simple analysis. In the case of ATM’s, automating a bank teller’s main role triggered two other important results. The first is that introducing ATM’s makes the cost of operating a bank branch lower as it is possible to replace a certain percentage of human labour with cheap machine labour. This results in a better service to customers via the bank opening more bank branches - branches which will need tellers. The second important result is that the automation of part of the teller’s job made the other parts of their job more profitable, thusly increasing the banks demand for teller labour. With more bank branches open, customers came to a branch more frequently. Thanks to the ATM tellers have more time to focus on the sales of other products like cards, mortgages, lines of credit, and most importantly time to focus on forging a relationship with their customers. In the case of the ATM, automation did not replace the market for human labour, it simply changed the landscape of it while serving a broader base of customers and increasing the welfare of all of those involved. This was the same case for the invention of the wheel, the telegraph, and even the telephone (to a certain extent). In the case that automation does fully replace a job, the efficiency created by the automation will create more aggregate demand for more jobs elsewhere.

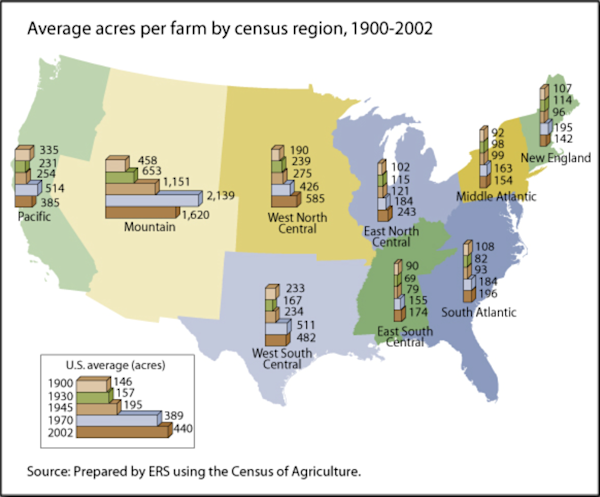

Although the introduction of automation to a process does not always result in increases in labour demanded via augmentation, it does (always) result in improved efficiency and profitability of a given economic activity. A great example of where the requirement for labour fell while the profitability of the system rose is farming. A hundred years ago, almost one out of every three people in the United States were farmers. Farming was a primitive process; only basic tools existed to augment human and horse labour. Because farming was such an inefficient process, the average farm was less than 150 acres in size, as compared to the modern day where farms are over 450 acres in size on average (size change varies by region, see Figure 2 for data up to 2002).

Figure 2: Evolution of Farm Size

Source: U.S. Department of Agriculture

In the 1920’s, tractors started to become more affordable to farmers. In accordance with this change, the number of farms in the United States increased, peaking in 1935 at ~6.8 million farms. Between the 1920’s and 1930’s, the United States also saw unprecedented population growth of over 15% in a decade, as the nation became capable of feeding more mouths and farming more ground. Beyond 1935, automation in farming began to replace the need for human labour, with the introduction of electrical milking machines and irrigation pumps, larger tractors, combines and planters, and mechanical cotton pickers and sprayers. As time progressed, we have created technologies such as GPS-guided combines and tractors, computer controlled irrigation systems, robotic harvesters, and more. As a result, there are just over 1.9 million farms in the United States at present, in spite of the American population having tripled over the last century. Remarkably, the amount of land being farmed in aggregate across the lower 48 has remained virtually unchanged, testament to the spectacle of automation. Although the number of people required to farm has decreased significantly, the fixed assets associated with the task (farmland) have remained completely unchanged, while the number of mouths to feed has roughly tripled. Farming has become a remarkably efficient process, and is a much better business to be in than it was a hundred years ago.

From this analysis we can ascertain two key takeaways. The first is that automation is an enabler of human efficiency, and often the introduction of automation will increase the demand for human labour in the same space. This was the case with ATM’s and a long list of other inventions over the span of humanity. The second is that even when automation becomes strong enough to replace human jobs in full, the process which has been automated becomes significantly more efficient and more profitable.

Polanyi’s Paradox

Let’s assume that you are reading this in your office, seated in a chair. If I ask you to stand up, it is a very simple thing to do; any able bodied human above the age of two can do a task this simple. But what if I asked you to describe how you did it? What neurons in your body fired? What muscles twitched? How did you use your proprioception instincts and the fluid on the inside of your ear to maintain balance? These are not questions we can answer, but we can all get out of our chairs. We can all do things much more complicated than get out of a chair; like hit a baseball, crack an egg, drive a car, or construct a persuasive piece of writing. None of these tasks are things which we can explain; our ability to execute them is a function of millions of years of evolution which forged the bodies we live in today and the brains which operate them.

Figure 3: Michael Polanyi

Source: infed.org

Michael Polanyi was a renowned early 20th century polymath who made various important contributions in chemistry, economics, and philosophy. In regard to the phenomena described above, Polanyi’s Paradox simply states that “We can know more than we can tell”. A large number of the tasks which humans perform are those which we only understand tacitly and which can not be articulated or codified exhaustively. These tasks are those which are the most difficult to automate, as the process of automation requires us to describe or codify a task exhaustively to a computer. Tasks which satisfy Polanyi’s Paradox come in two different forms: physical tasks and abstract/managerial thinking. Physical tasks are those like getting out of your chair. Although building a robot which simply gets out of a chair provides zero economic value, there are millions of jobs which constitute physical tasks, like a construction worker swinging a hammer, a waitress bringing you your dinner, or a taxi driver getting you to your destination. Abstract and managerial thinking is the other side of the coin; it is the thought we put into our big decisions, the why behind every decision we make. The most basic abstract choice we make is deciding to be alive, we don’t really understand why we are alive but for the most part we decide to keep doing it. Most abstract thought tasks are related either directly or indirectly to our choice to be alive. It is easy for us, as human beings to know that we should build houses to live in and grow food for us to eat, however it is not easy for a robot to understand this as it does not understand why we decide to be alive. This phenomena brings to mind a quote from Carl Sagan; "If you wish to make an apple pie from scratch, you must first invent the universe,". This is the approach which a computer brings to any open ended task, and it presents significant challenges for automation. The strategic direction of any firm, government, or individual all rely on abstract or managerial thinking, and thusly have proven very difficult to automate.

Computer scientists have relied on two main tactics to try and combat Polanyi’s Paradox. The first is simplifying the environment in which automation is employed. Think about, for example, an individual who works putting tape on boxes at a warehouse preparing packages to be shipped out. This is a textbook case of a physical task which is difficult to codify; there are tons of different shapes of payloads which go in each box, you have to decide how much bubble wrap to put in, you have to choose an appropriately sized box, appropriately sized tape, and apply a unique tape job to each package. How could this be automated? Create standard box sizes, tape sizes, and use packing peanuts which can be poured into each box until full, all done on an assembly line. The environment which the task is performed in is now much more simple; there are a finite number of boxes and you can have a machine which handles each size and only must learn how to do a single kind of tape job rather than actually learning what it means to tape up a box (and why to bother doing it; abstract thought). This method, along with the second method, is frequently used in automated driving. The second method is machine learning, the cornerstone of modern AI. The process of machine learning at a high level is surprisingly straightforward; create a machine which is capable of connecting dots and expose it to dots. A machine which is capable of connecting dots is a data center, and the dots which it is exposed to is all of the writing, videos, and photos which the company training said AI can get their hands on. Text, images, and videos used for training are converted into ‘tokens’ which are numerical representations of a certain word (for example, “is” could be “56” and “cool” could be “490”). Code is written with parameters that incentivize the wires, chips, and other hardware to guess the most probable token to appear in an unfilled slot, and the machine is exposed to the data. Once the data is reviewed, the machine will be subject to tests such as “The ___ in the Hat, Dr. Seuss”. If the machine responds with “Cat”, this is recorded as a positive outcome, and the machine recalls the result for future use. If the machine responds with “Dog”, this is recorded as a negative outcome, and the machine will assign “Dog” as having a lower probability of being the right answer to the query in the future. When done trillions of times with all of the data which humanity has created, we create a machine which is capable of speaking to us, finding important information for us, and creating important things for us, all by guessing the next best word to answer our query.

The reality is that modern AI does not think (unless you consider guessing the next best word to say a thought), and there is no solution, current or prospective, which will change that. The bleeding edge of the AI space is employing more and more scale, as having more wires, training time, and data means your model will have more time to learn what token to guess and more resources for creating a guess, thusly creating a stronger model. In addition to scaling, models are now being trained to assign certain areas of its hardware to expertise in certain areas, while also employing the use of information retrieval from third party (the internet) rather than raw recall power when answering a query. Cutting edge models are also being trained to evaluate their own logical direction in answering a query as a tool for creating a stronger output, this is what is happening when ChatGPT tells you “Thinking longer for a better answer”. Although these tactics already have, and will continue to, help build more effective AI, none of them allow AI to concur the hurdle of abstract thought, and it will take a significant change in approach to do so.

In spite of Polanyi’s Paradox, modern AI scientists have all created forecasts for when we will be able to create superintelligence; a machine which would be capable of doing a better job at every task than a human could. It is rare that you encounter a forecast with a time frame of less than 2-3 decades. Can we take their word for it? In Constellation’s investor call on AI and its impact on CSU (link), founder Mark Leonard told a story about Geoffrey Hinton and his 2016 forecast for AI’s impact on the practice of radiology. Hinton, “The Godfather of AI”, forecast that within a decade radiologists would be rapidly replaced by AI, and that it would be foolish to train yourself as a radiologist. Instead, the number of U.S. board certified radiologists has grown at a rate well outpacing total job growth in the United States over the last decade. Why? Augmentation has made the practice of radiology significantly more productive, lowered the cost of providing care, and increased consumer demand for the service, just like in our ATM and bank teller example. This story demonstrates a few important things. For one, being an expert in computer science does not translate to being an expert in labour economics, augmentation, or radiology. When we consider predictions made by a computer scientist on the impact of their work on other fields, it is usually not a well informed opinion. Additionally, this story demonstrates that being an expert in computer science does not mean that you can predict the future of computer science.

From the 1660’s to his death, Sir Isaac Newton wrote over one million words on the science of alchemy: the process of creating gold out of thin air. Newton believed for decades that he was on the cusp of being able to successfully modify matter and create a desired substance out of empty space. Outside of alchemy, Newton’s contributions to modern science are astounding; he invented calculus, arguably the most useful mathematical tool ever created. He created the three laws of motion and the universal law of gravitation, laws which explain physical phenomena and are the foundation of the entire field of physics and engineering in the modern world. Newton is arguably the greatest, or most influential, human mind in history, and yet he believed for decades that he was on the cusp of being able to create gold out of thin air. What would his forecast for successful alchemy have been in 1660? Hundreds of years later, it has not been fulfilled.

The Geoffrey Hinton’s and Alexandr Wang’s of today’s world are, in their own respect, our versions of Isaac Newton; they have created the most useful tool humanity has ever seen. They have created a technology which will change the trajectory of humanity for all of time, but despite this, they can not create gold out of thin air. With the techniques that are currently being employed in computer science to overcome Polanyi’s Paradox, it seems highly unlikely that a machine which can replace our abstract capabilities is built in the foreseeable future.

Artificial Intelligence and Constellation Software Inc.

With an understanding of the fundamentals of automation and the means by which AI is developed, we can now assess the validity of the paranoia surrounding the impact of AI on Constellation’s business model. Various investor claims were discussed on CSU’s September webcast on the impact of AI on the Constellation business (link), below we will address each of them individually before providing a realistic summary of how continuing automation will impact Constellation.

Claim: Building customized solutions will become lower cost and VMS customers will shift to a customized solution.

Of all of the claims which we address, this is the only one with an aspect of validity, the only problem with this claim is that it has a narrow aperture and does not address the other effects of AI on the CSU business. Yes, a decrease in costs and increase in product offering by customized solutions providers means that customers on the larger end of the VMS client base may opt for customized solutions. It is important to consider though that the cost of VMS will also decrease, as the efficiency created by AI also has a significant positive impact on CSU’s ability to build and manage software. For CSU, AI and its augmentation with human capabilities will enable the company to profitably build VMS for more markets, while also creating more differentiated solutions within an existing vertical. This is par for the course as far as the past few decades go; the costs of SaaS falls and the addressable market grows. The question is what will be larger, losses from large clients or gains from small and medium sized clients. Although this is a difficult question to answer, and the net effect will likely be small once compensated for the offsetting nature of the two forces at play, we lean towards seeing a positive net effect for CSU. According to the United States Chamber of Commerce, businesses with under 500 employees account for nearly 45% of U.S. GDP., while businesses with over 10,000 employees accounted for about 37%. CSU’s addressable market (by business size only, not by niche vertical) then only accounts for the remainder of GDP, ~18%. With AI, a fraction of this ~18% will be able to economically employ customized solutions, while a fraction of the ~45% of GDP controlled by small businesses will be able to economically employ VMS. Although it is not clear what fraction of each group will shift out of or into VMS, it is clear that the unaddressed market in small businesses and niche verticals is much larger than the pool of companies who may graduate from VMS to customized solutions if costs continue to fall.

Claim: Larger VMS customers will opt for building their own platforms with the help of AI rather than relying on a third party like CSU for software needs.

There is a reason this has not already happened as the barriers to building your own platform have fallen over previous decades, and the reason is specialization and competitive advantage. SaaS exists for a reason: software companies are capable of building and managing software better than the IT department at any non-software corporation. As a result, the lowest cost way of securing good software for a non-software company is to pay an expert to build and manage the system. Software companies are better than non-software firms due to their human capital, which is still the case with the development of AI. Research finds that the effects of augmentation are actually stronger when the human being augmented is more capable, meaning that modern AI should actually continue to grow the gap between a SaaS company’s competitive stance as compared to a customer’s internal IT department. The only way this paradigm could be shifted is if AI became capable of building a software solution without any human help whatsoever, an outcome which we do not believe is reasonably foreseeable and has been sufficiently discussed above.

Claim: Customer spending on AI will exhaust budgets and decrease the amount of spending directed to Constellation.

The software which Constellation provides is generally critical to the everyday function of the businesses which employ it. Cutting spending on CSU products would require a replacement strategy. For a simple example, if a golf course stops spending on Constellation software, they now need an alternative way of booking tee times. You could ask an AI agent to remember the schedule (AI does not have strong memory capabilities, essentially because our conversations are not part of its training), put dates and times into an excel sheet, or just write it on a napkin. None of these alternatives are better than employing a purpose built program for scheduling tee times, and AI does not change the cost-benefit trade-off between using software or a napkin. If paying for AI is a good investment for a business, they will make that investment, but it is not a replacement for purpose built software which is at the heart of a businesses functionality, and thusly this claim is invalid.

Claim: Using AI for internal purposes will increase CSU’s costs as hyperscalers increase pricing.

AI is an incredible tool for both a programmer and a sales & marketing professional. With CSU being a cutting edge firm who employs professionals in both of those fields, it is not surprising that the company has adopted AI to a high degree, with top management stating that they have seen a 400%-450% month over month increase in adoption in recent years. There is a line of thought which believes that hyperscalers will eventually raise the price of accessing their models significantly, which for a company like CSU, who uses AI lots and will likely use it more and more in the future, could add significant pressure to profitability. AI is a new tool and did not play any role in the margins which CSU realized a few short years ago. This level of margin, with raw human capability only, is a floor; if access to AI was sold by monopoly, the highest price a hyperscaler could charge is such that a firm like CSU would be no more profitable with AI than it was without AI. This is not a scary thought for an investor; although CSU may employ less people over time, there is no reason for margins to fall from recent levels as it is always possible to ditch the use of any LLM and only use human labour. One may purport that this may not be possible if a VMS competitor was able to run a similar business at a lower cost while using AI, but that is an unrealistic scenario as CSU is currently a market leader. Another important thing to consider is that access to LLM’s is not sold via monopoly, it is actually a highly competitive space. Competition between ChatGPT, Grok, Claude, Gemini, DeepSeek, and a list of other competitors eliminates a lot of the pricing power which a single company could otherwise demonstrate over a corporation like CSU, and thusly the gains from the efficiency created by AI are shared between both the creator and the user. For these reasons, we believe this is an illegitimate concern.

Claim: AI will be destructive to Constellation’s acquisition strategy.

There is no clear reason why AI could be destructive to Constellation’s acquisition strategy. Constellation’s competitive advantage in their acquisition strategy rests on their size, access to capital, and their ability to “fix up” acquired targets. Clearly AI will have no impact on the size of CSU (size measured by physical infrastructure like staff, not by market cap) or their access to capital; it is the third leg of their acquisitive advantage that we will unpack in more detail. CSU’s ability to optimize acquired software and sell it to a broader base of customers is a function of their expertise. The only scenario where this advantage could disappear, similar to the scenario where customers build their own software internally, is the scenario where AI can do the entire job of Constellation free of any human supervision. For any other strength of AI that is developed, augmentation will impact the human makeup of the corporation, but it will not degrade CSU’s strength and knowledge over how to manage and optimize a software system.

A Realistic Expectation

We believe that Constellation being a significant beneficiary of the development of AI is a much more realistic (and logically sound) scenario as compared to any of those discussed above. As the strength of AI increases, the number of places where SaaS can be employed increases greatly. Certain customers flow out of VMS into customized solutions as the costs of producing SaaS, and subsequently the cost of SaaS for a customer, falls. A different set of customers of both medium and small business size are now addressable by VMS, which according to economic data is likely a significantly larger dollar value of customer base than that which exits VMS. AI augments human capabilities at CSU and the process of building, managing, acquiring, and selling software becomes radically more efficient, boosting margins regardless of if more or less human capital is required. Hyperscalers may raise prices, but competitive pressures in the space prevent a scenario where the entire efficiency gain of the technology is captured by the seller. Constellation’s acquisitive growth strategy remains intact, and the company compounds capital at a very similar (if not slightly higher) rate compared to what it has historically.

This is a very realistic outlook for the company which also happens to be almost entirely positive. After discussing Constellation’s management and board, we will build out this scenario in financial forecasts to estimate a reasonable value for Constellation’s shares.

Corporate Governance and Management Alignment with Shareholders

Constellation was founded by Mark Leonard, who served as President and Board Director until September 25th of this year when he was forced to resign from his position as President for health reasons. For context, Leonard is currently 69 years old, and he has maintained his position on the board of directors. Leonard is succeeded by Mark Miller, the previous COO of Constellation since January of 2001, as well as previous CEO and current Executive Chair of Volaris Group, a Constellation company. Miller is likely the best possible candidate to lead Constellation going forward. CSU’s continuing success relies on the execution of their acquisition and software management strategy over all else. With close to three decades of experience working along side founder Mark Leonard on allocating capital and managing operating areas, Miller is undoubtedly capable of replicating the previous success the company saw with Mark Leonard at the helm.

Two other important pieces of the puzzle as far as Constellation’s continuing success in acquisitive growth are their Chief Investment Office, Bernard Anzarouth, and Farley Noble, SVP of Large Investments and Strategy. Anzarouth has spent the previous 30 years of his career with Constellation as CIO, playing a significant role in the growth of the company from startup to mega cap. Prior to working with CSU, Anzarouth worked as both a systems engineer with IBM, and in business development with Ascom Holding AG, a healthcare technology company. He holds both a bachelor’s in electrical engineering and an MBA. SVP Farley Noble has also spent nearly the entirety of his career with Constellation, however in various roles of increasing seniority. From 2000 to 2018, Noble climbed the ranks through various finance and corporate development positions, spending the period from 2012-2018 as VP of Acquisitions and Corporate Development for the Jonas operating unit. In 2019 and 2020, Noble took a temporary hiatus from CSU to found a pair of niche software brands, before returning to CSU in his current role in 2021.

The final crucial link to Constellation’s management team is CFO and board member Jamal Baksh. Like many other exceptional Constellation management members, Baksh has spent most of his career with CSU. Prior to 2004, Baksh served as Accounting Manager at Dell, preceding a decade of service with Constellation as VP Finance and a subsequent 12 years of experience as CFO.

Constellation’s board consists of nine members, an appropriate headcount for a company of this size and complexity. The board is headed by John Billowits, a long serving member of senior management of CSU up until 2020. Billowits also has prior experience in consultancy for Bain, as well as financial management for Dell and PwC. The Constellation board exhibits impressive levels of experience in investments, law, and software, by far the three most important areas of expertise required to provide value on the CSU board. Some highlights include Robert Kittel, who holds previous experience in corporate investments with Cadillac Fairview and third party investments as President of a Canadian hedge-fund, Andrew Pastor, a Partner at the exceptional Canadian hedge-fund EdgePoint since 2013, Laurie Schultz, President and CEO of software company Galvanize from 2011-2021, and of course Mark Leonard, the founder and long serving President of Constellation. Eight out of nine CSU board members are independent (CFO Jamal Baksh is the exception), and no director serves on the board of more than two other companies.

Constellation’s executives are compensated via both cash salary and annual bonuses with which they are required to invest a minimum 75% into CSU shares. Shares purchased in accordance with executive compensation may not be sold for a minimum of four years, incentivizing long term shareholder value creation. In general, ~25%-35% of executive compensation comes in the form of base salary, meaning that ~50%-55% of compensation is “share-based”. Annual bonus size is based on two factors: ROIC and annual revenue growth. We like the mix of these two metrics, as when combined they incentivize profitable growth and the efficient allocation of capital across acquisition targets and organic initiatives. As a function of the executive compensation plan, all executives own a significant amount of shares in CSU. All directors also own a significant stake in the company, as well as interests in publicly traded CSU operating groups Lumine Group Inc. and Topicus.com Inc. In general, we believe that the people and processes are in place for Constellation to realize continuing success via their corporate governance practices. The experience of the board and management team, compensation structure of key players, and insider ownership tick all of our boxes for aligning shareholder interests with that of management and the board.

Valuation

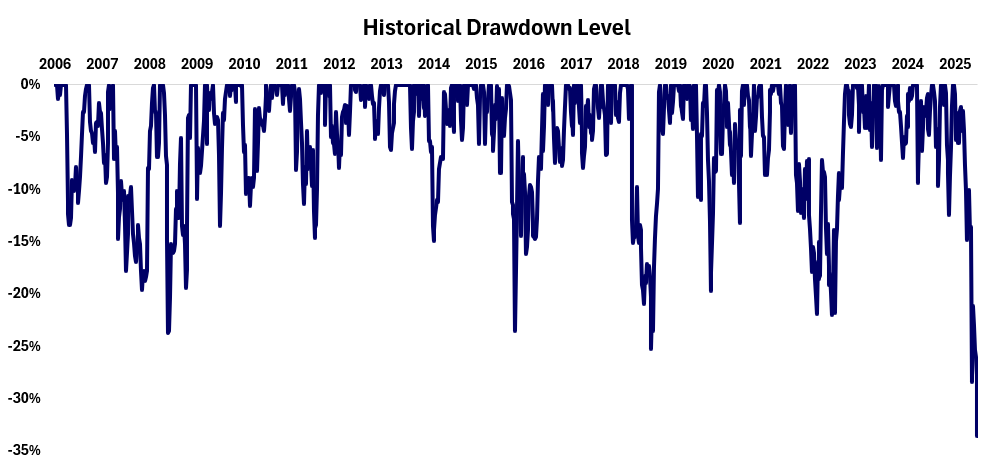

Constellation’s shares are currently at the furthest point they have ever been from an all time high (drawn down ~35% from this summer). Figure 4 shows CSU’s drawdown level over time:

Figure 4: Constellation Historical Drawdown Level

Source: S&P Capital IQ, Phi Research

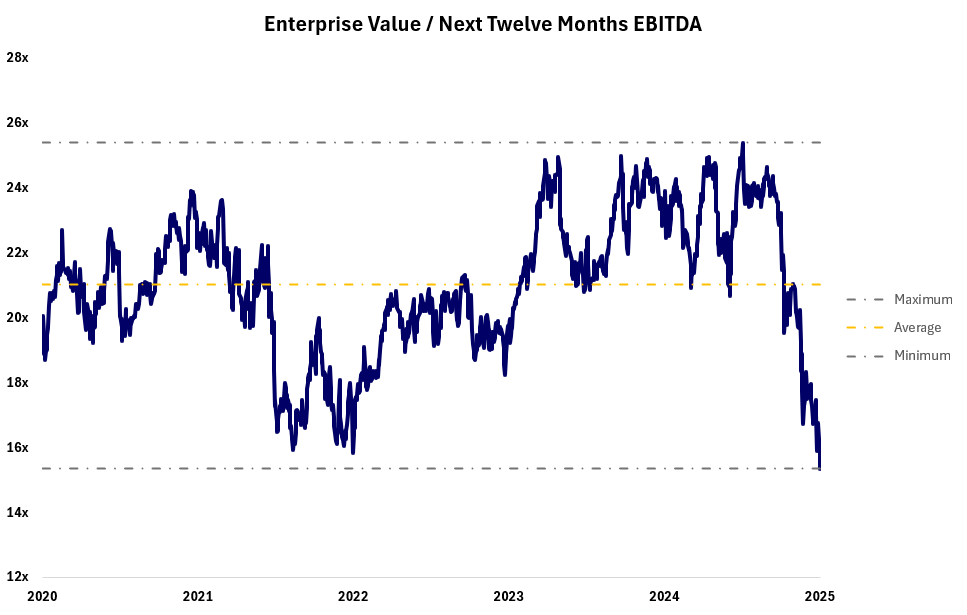

The paranoia in the market around CSU has not been in accordance with falling financial performance or estimates. As a result, Constellation has fallen to a five year low on an EV/EBITDA basis, making shares extremely attractively valued from a relative valuation perspective. Figure 5 shows CSU’s relative valuation over the last five years

Figure 5: Constellation Software Enterprise Value / Next 12 Months EBITDA

Source: S&P Capital IQ, Phi Research

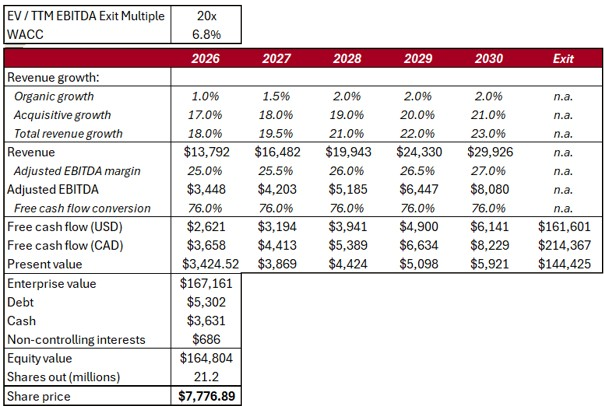

On a surface level, shares appear to have fallen well into value territory, but to strengthen our case we will build out a simple discounted cash flows model to garner a more exact idea of what CSU should be worth. Our financial estimates are based on the realistic case we have laid out for AI’s impact on CSU’s business model, are rooted in historical performance, and are roughly in line with some of the more bullish estimates from the street.

Figure 6: Discounted Cash Flows Model

Source: Phi Research

Constellation has exhibited revenue growth averaging ~21% and organic revenue growth of ~2% annually in recent history, with 2025 expected to finish off slightly below the long term average. In our view, the efficiency which CSU captures from AI will enable the company to exude pricing power and the capture of certain newly addressable customers organically. In spite of this, organic growth may be weaker at times than the historical average as large players cycle out of VMS and into newly affordable customized solutions. At the same time, AI’s expansion of the VMS addressable market will fuel the acquisitive growth engine, as targets are built to address new customers with unique needs. Adjusted EBITDA margins will expand slightly in accordance with the efficiency which CSU realizes from the use of AI, all of which can not be recaptured by the LLM provider due to competitive factors. We expect free cash flow to convert from EBITDA at a rate that is reflective of historical averages; there are no reasonably foreseeable reasons for working capital or maintenance capex needs to change going forward.

We utilize an EV/TTM EBITDA exit multiple of 20x for our base case terminal value, roughly reflective of recent average levels (see Figure 5) and a terminal free cash flow yield of 4%. We convert our USD free cash flow estimates to CAD using the uncovered interest parity, and then discount our estimates using a WACC calculated in the standard method (beta of 0.78, required return of 8%). Our base set of assumptions brings us to an implied share value of $7,776.89, representing a nearly 130% premium over CSU’s last closing price of $3,392.88.

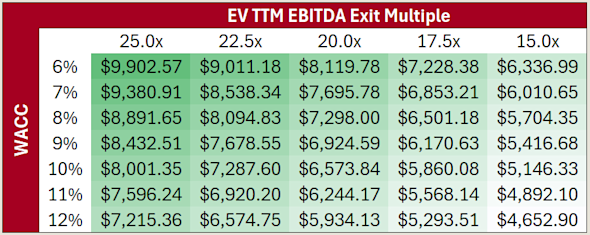

It is important to test some of the key assumptions which our model uses to determine share value; namely the exit multiple used and the discount rate. We believe that it is interesting to test various discount rates in our analysis as AI does legitimately change the fundamentals of the VMS business, and thusly a backwards looking beta calculation may not be reflective of a forwards looking discount rate. Figure 7 shows our sensitivity analysis on our discounted cash flows output:

Figure 7: Sensitivity Analysis

Source: Phi Research

Regardless of the assumptions used, we find that in all reasonably foreseeable scenarios Constellation is worth significantly more than its current market value.

Conclusion

Constellation Software is an exceptional business in every way and has spent decades proving it. Although the advent and continuing development of modern AI create a shade of uncertainty around the business, a logical breakdown of the impact of AI on CSU paints a pretty picture for the future of the business. Regardless of how many programmers are employed at the corporation, the firm’s competitive advantage is sound, and the addressable market of their product is poised to increase greatly. With the recent drawdown in the price of CSU shares, we believe now is an incredible time to enter a position in what has historically been Canada’s greatest compounder. Strong Buy.