Telesat Corporation (TSX: TSAT), The Final Frontier

Published on 2025-06-29

Telesat Corporation is a leading global satellite operator, offering services for voice, data, and video communications and high-speed internet access. Dramatic growth in global demand for broadband services has presented the company with a unique opportunity to expand operations into the low Earth orbit satellite space, through the buildout of its 198 satellite constellation: Telesat Lightspeed. Telesat offers investors a high-risk, higher-reward proposition, with the potential for truly explosive returns. At current levels, we view the shares as a Strong Buy.

In 1972, Telesat Canada, a Canadian government entity, launched the world’s first domestic commercial satellite into geostationary orbit. The modern version of Telesat is the result of a 2007 combination of Loral Skynet and Telesat Canada led by PSP Investments. Since 2007 TSAT has operated satellites in geostationary orbit (GEO satellites), with a current count of 14 satellites providing services to leading telecommunications and media firms in the United States and elsewhere. GEO services are also utilized by government agencies, individual consumers, and for maritime and aeronautical connectivity purposes.

Satellite operations compete with terrestrial networks (e.g., cable, DSL, fiber optic, cellular/wireless and microwave transmission) in the market for video, data, and voice communications services. Satellite services hold a competitive advantage in areas which terrestrial networks are not able to reach. For large and remote areas, which can potentially host populations of hundreds of millions of individuals, it is much lower cost to utilize satellite services than to construct further terrestrial infrastructure. The terrestrial construction required for expanding satellite coverage in such areas is limited, with almost the entirety of costs being incurred in the construction and launch of the satellite network. This allows for a much more flexible network of coverage, which can be deployed quickly in the case of a natural disaster, military asset movement, or other high impact and fast-moving use cases. Satellite networks also have the capability to bypass shared and congested terrestrial links. From a service quality perspective, low Earth orbit (LEO) satellite services are on par or in certain cases higher quality than terrestrial networks.

Telesat Lightspeed

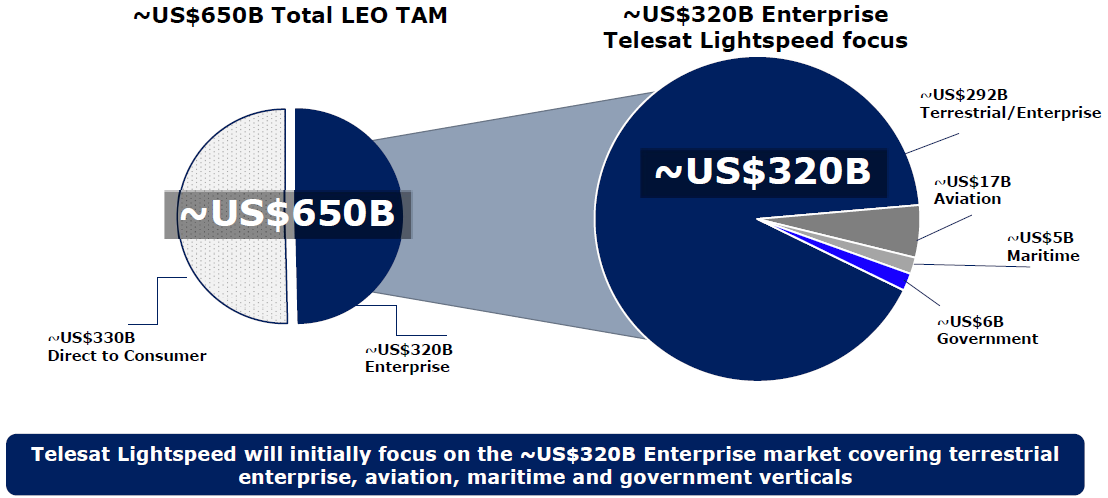

The demand for connectivity solutions is ever increasing in the human world. Currently only 2/3 people on Earth have access to internet services, roughly 75% of the globe does not have 5G coverage, and nearly 15% of individuals in the United States do not have broadband access. In many of these areas, it would be prohibitively expensive (or in the case of naval and aeronautical cases, impossible) to install terrestrial infrastructure to fill these broadband gaps. Corporations, individuals, and governments alike are all seeking cost-effective connectivity solutions at increasing rates, especially to establish connections in remote areas, in aerospace, and for naval applications. The prospective leading solution for these demands is LEO satellite networks. Telesat estimates that by 2032 the Total Addressable Market for LEO services will be ~$650B USD annually. Of this ~$650B, approximately 50% will be direct to consumer services and the remaining ~50% will be enterprise. To capture the growing demand for LEO services, Telesat is constructing a 198 satellite constellation named Lightspeed. Figure 1 shows a breakdown of Telesat’s estimated TAM:

Figure 1: Lightspeed LEO Total Addressable Market

Source: Company Presentation

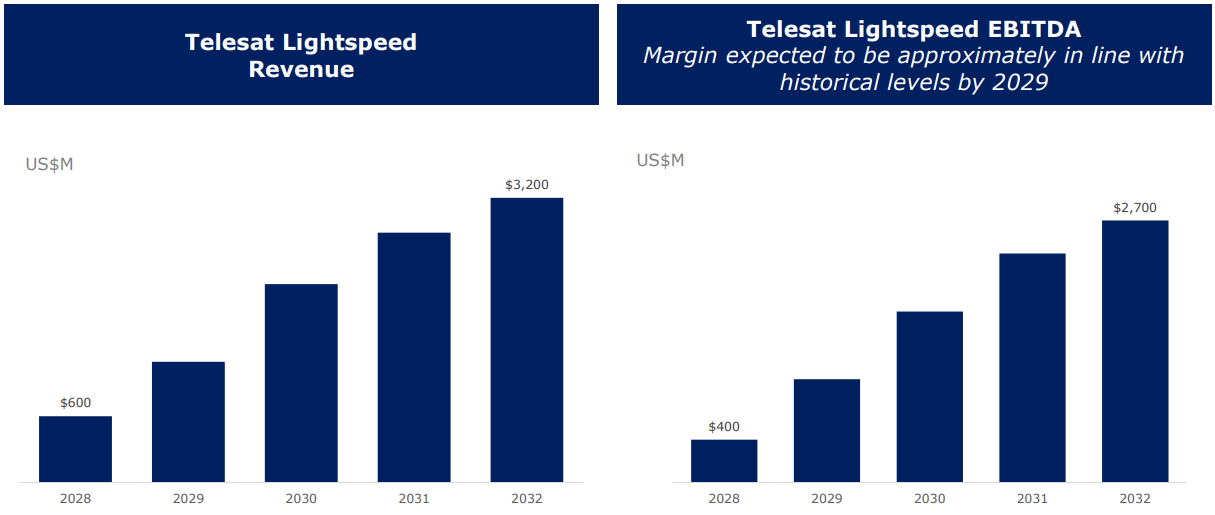

Lightspeed is being constructed to target enterprise level clients, of which Telesat expects to capture roughly 1% of demand by 2032. Figure 2 shows Telesat’s estimates for Lightspeed revenues and EBITDA:

Figure 2: Lightspeed Financial Estimates

Source: Company Presentation

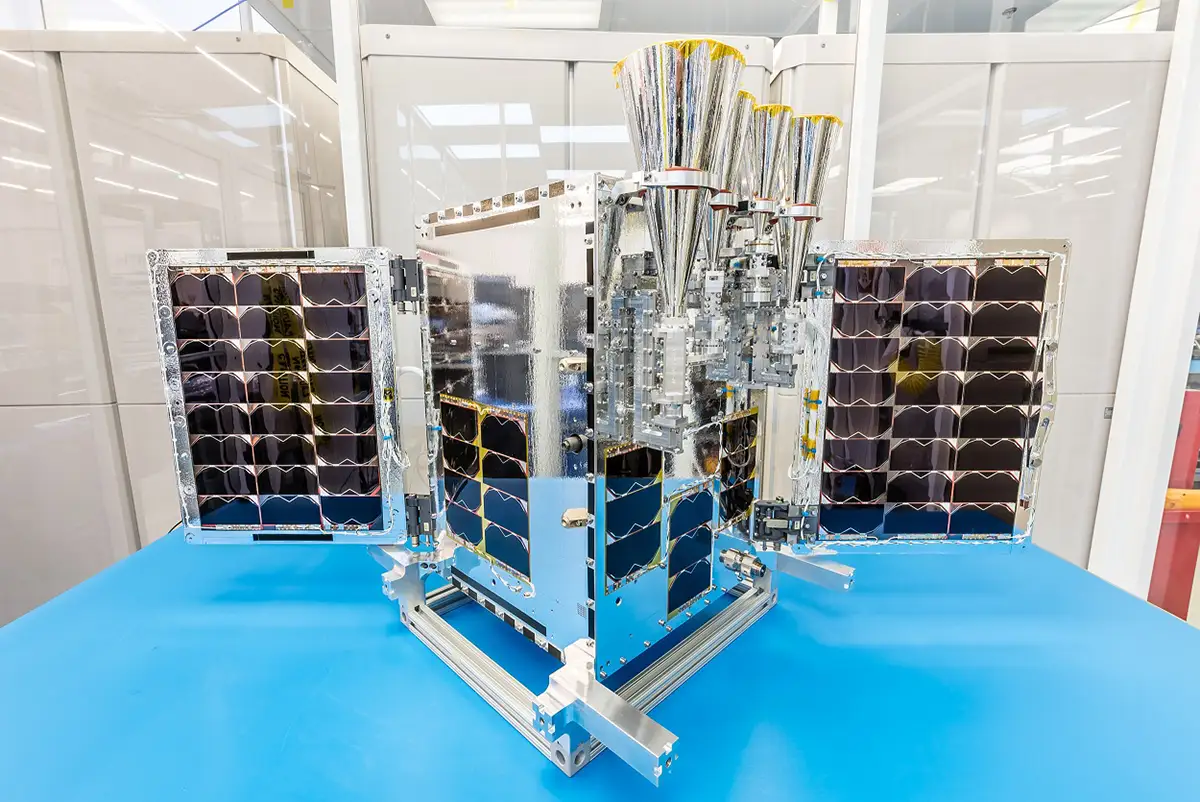

Relative to GEO satellites, LEO networks offer services that are more than five times faster, significantly lower latency, and more flexible in areas of the globe for which coverage may be provided. GEO satellites orbit the Earth in a geosynchronous pattern at an altitude of roughly 35,000km, meaning they remained in a fixed position above the Earth’s equator interminably. GEO’s provide “blanket” coverage of a fixed area, and are only operational when in unobstructed view of a corresponding Earth based antenna. In contrast, LEO’s have variable paths of travel around the Earth, at altitudes ranging from 325km-1,400km. LEO’s operate in a network or “constellation”, which upon connection and strategic coordination of positioning and orbits can provide true “pole-to-pole” coverage of the globe. LEO satellites are placed in orbit at the end of launch processes, with launch rockets providing them with sufficient energy to continue orbiting for the remainder of the satellite’s useful life. Through establishing a network of orbiting LEO satellites, it is possible to provide higher quality service across the globe, including in high latitude areas which GEO satellites could not previously reach due to their positioning and lack of movement. Figure 3 shows a LEO satellite prior to launch:

Figure 3: Low Earth Orbit Satellite

Source: Payload

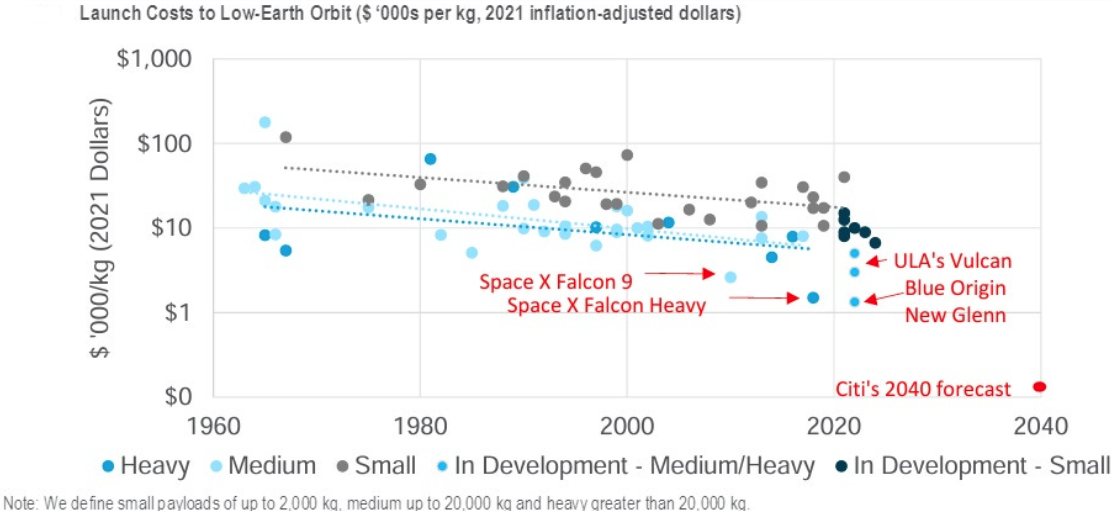

A significantly higher number of satellites are required for the operation of an LEO network in comparison to GEO coverage. Historically the requirement to launch these higher numbers of satellites into orbit has presented challenges to the economics of operating such networks. In recent years, launch costs have decreased dramatically, largely attributable to advancements made by SpaceX. Figure 4 shows the evolution of launch costs over time. Estimates from Citi and Goldman Sachs see continuing declines in costs down to $100-$200 per kg in a modified exhibition of Moore’s law.

Figure 4: Satellite Launch Costs

Source: American Enterprise Institute, Citi Research

Telesat has launched a number of test LEO’s in anticipation of the completion of its full Lightspeed service offering. In 2018, LEO 1 was launched into orbit and in 2023 LEO 3 was launched to continue testing and customer demonstrations. In a test with customer Nelco, India’s leading and fastest growing satellite communication service provider, LEO 1 demonstrated 35 millisecond round trip latency, more than fast enough to provide optimized performance for online gaming or live video conferencing, both of which are tasks with high requirements. To date, TSAT has contracted the services for the construction of satellites (MDA Space), launch of satellites (SpaceX), landing station baseband units (Satixfy, recently acquired by MDA Space), and other terrestrial infrastructure (Orange and Vocus), with construction well underway.

The LEO connectivity space is not without competition. Competitors Intelsat, SES, Eutelsat, Viasat, and SpaceX are all constructing similar networks, with SpaceX and Eutelsat having launched initial operations on their networks. Telesat maintains competitive advantage in the form of its orientation towards enterprise clients, as well as its technical knowledge, enterprise and government relationships, and understanding of regulatory environments which has been accumulated over 55 years of satellite operations. In the history of the internet, there has never been a time where high-speed services have ever been overbuilt or without sufficient demand, and the company has shown through its test satellites that Lightspeed will indeed offer service quality on the cutting edge. As a result, the company has accumulated a backlog of over $1B, with significant contracts from Artel, Mage Networks, Airbus, Space Norway, Telecom, Viasat, Arabsat, and others. Notably, 100% of backlog is non-cancellable.

Corporate Governance and Management Alignment with Shareholders

Telesat is currently led by President and CEO Daniel Goldberg. Goldberg is a highly qualified and competent individual who graduated from Harvard Law School, which preceded a decade long and successful career in the legal world. From 1998-2000, Goldberg served as General Counsel for New Skies Satellites, after which point he was promoted to COO, and subsequently CEO. After 8 years with New Skies Satellites, Goldberg joined Telesat in 2006. Goldberg is clearly an individual who has options, and it is a major positive signal to see that he has chosen Telesat as a place for employment (and more importantly a place to hold nearly two million shares and options). In general, the Telesat executive suite is filled with highly qualified individuals, the large majority of which come from engineering-based backgrounds and many of whom have completed post-graduate studies. These are additional major positives for a corporation which requires a high degree of technical knowledge for the execution of its goals. Full management profiles can be found here (link).

Telesat’s board is led by Dr. Mark H. Rachesky, founder of MHR Fund Management, Stanford MBA and MD. MHR has approximately $5B under management, of which nearly 10% is allocated to shares in Telesat. Dr. Rachesky is, like Dan Goldberg, an intelligent individual with a variety of options at his disposal who has decided to trust his future with Telesat. In total the board of Telesat has 10 members, with all but one member holding a significant equity stake. Apart from Dan Goldberg, the remaining 90% of board members are independent. We see the board’s previous experience and qualifications as outstanding, with significant cumulative experience in private equity and portfolio management, audit, government relations, law, telecommunications, and satellite operations. Full board profiles can be found here (link).

Telesat executive compensation consists of three elements; base salary, annual cash incentive rewards (yearly bonus), and long-term incentive plan compensation (LTIP). Base salary is determined in part by third party consultants and benchmarked to comparable firms. Yearly bonuses are cash settled and are based upon annual adjusted EBITDA targets and advancements of the Lightspeed project. In 2024, bonuses represented approximately 25%-30% of executive compensation, while base salary accounted for an average of 22% of total comp. The remaining compensation (50%-55% of total) stems from LTIP, for which Telesat employs the use of RSU’s, PSU’s, and options. CEO Dan Goldberg has over 350,000 options outstanding, with other executives holding between ~40,000 and ~90,000. Expiry dates are set for 2032 and 2033, an adequate timeline for the full realization of the Lightspeed project. In general we like the convexity of executive incentives which is present, and think that an appropriate amount of risk will be taken by management as a result. All LTIP measures are balanced well with anti-hedging and clawback policies. Additionally, all executives are required to own a minimum of 1x their annual base salary in shares, with CFO, CCO, CTO, and SVP Corporate Development being required to own 2x their annual base salary and CEO Dan Goldberg needing to meet the requirement of 5x annual salary.

Directors are compensated with an annual board retainer of $175,000, with a minimum of $100,000 to be paid in Telesat DSU’s. Directors are also granted additional retainers for each committee they serve on, ranging from $7,500 to $25,000 depending on the committee. Notably, TSAT does not grant meeting fees for directors, which we view as a significant positive. Additionally, board members are required to own 5x their annual cash retainer in shares (with exception of David Morin of PSP).

Telesat ticks all of the boxes from a corporate governance perspective. Board and management members have exceptional levels of qualifications and education. The compensation provided is competitive but not excessive, and utilizes cutting edge methods to align management incentives with shareholder's best interests. The majority of awards granted to both management and the board are share-based, equity ownership requirements are substantial, and when we consider the faith which these qualified individuals are putting in Telesat, the corporate governance picture is very pretty.

Valuation

Because of the explosive growth which Telesat anticipates it will realize through Telesat Lightspeed, we do not believe that looking at historical trading multiples is a relevant input in our valuation assessment. Instead we will build a comprehensive cash flows model, and then show potential long-term upside through a multiples valuation demonstration.

Adjusted Present Value Model

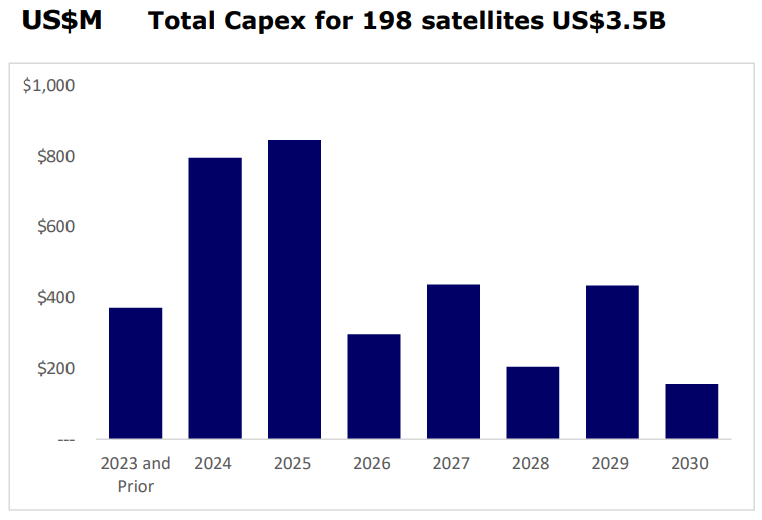

The construction of Lightspeed will require total growth capital expenditures of roughly $3.5B USD (see Figure 5 below for timeline of expenditures). Telesat’s current enterprise value does not exceed this amount by a significant margin, meaning that a high amount of debt financing is anticipated to be taken on and serviced between now and the completion of Lightspeed. As a result, we believe that an adjusted present value (APV or LBO) approach is suitable for our cash flow model.

Figure 5: Lightspeed Capital Expenditures Schedule

Source: Company Presentation

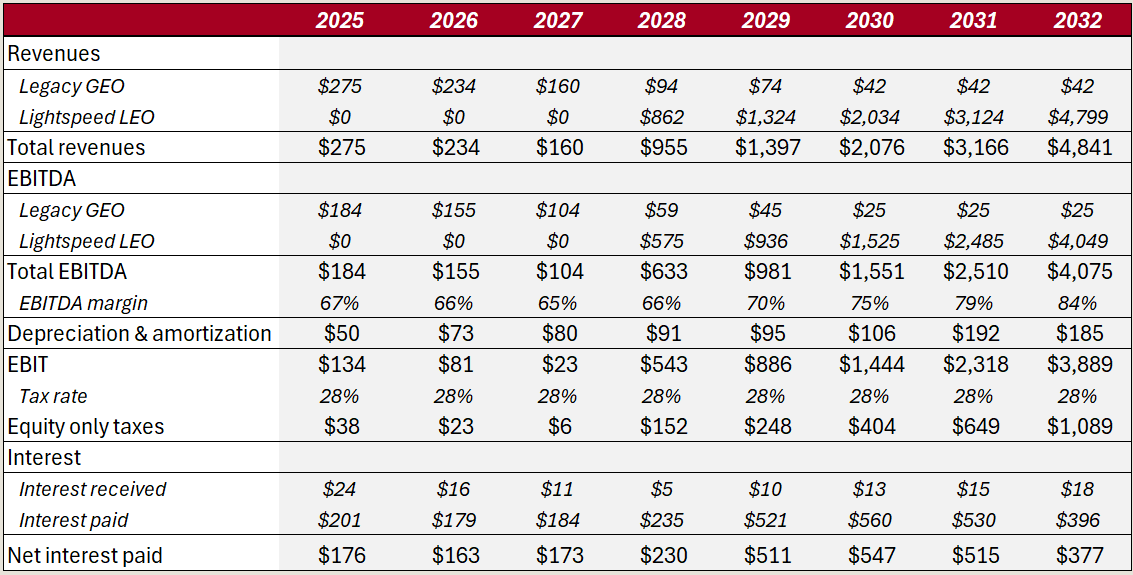

In our base case financial forecasts we have utilized management’s estimates for Lightspeed revenue, EBITDA, and capital expenditures. Estimates were given in USD, which we have converted to CAD using the covered interest parity (TSAT utilizes some currency hedging contracts). Figure 6 shows our cash flow relevant financial forecasts for TSAT at a corporate level. Note that all values are in millions of CAD unless otherwise specified.

Figure 6: Financial Forecasts

Source: Phi Research, Company Filings, Company Presentation

Our forecasts for Legacy GEO revenues are based purely upon current contracted backlog for the segment. We forecast EBITDA margins for the segment to fall from current levels of ~67% to 60% by 2032 as operating leverage kicks in with falling revenues. On the contrary, Lightspeed EBITDA margins are expected to jump from ~67% in 2028 to nearly 85% in 2032, in line with management’s expectations.

Depreciation is a function of total satellite PP&E accounts, which we have estimated to grow in line with management's expectations for the timeline of Lightspeed capital expenditures. Since we are modelling our cash flows like a leveraged buyout, we forecast equity only taxes (EBIT x tax rate, rather than EBT x tax rate), and will then consider the impacts of interest payments separately. Interest received is based on our forecasts for Telesat’s cash holdings, which must always exceed $100M as per covenants with their most recent financing agreement with the Government of Canada and Quebec. Between now and the end of next year Telesat will be required to refinance a significant portion of its debt, or secure new financing as a replacement. We have estimated that refinanced interest rates will be in line with those secured in the GoC financing agreement, which was set at CORRA + 4.75% (~7.5% at current CORRA rates).

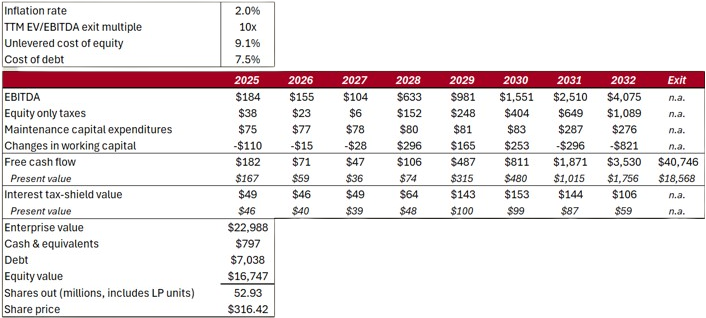

Figure 7: Adjusted Present Value Model (in millions of CAD except for share price)

Source: Phi Research, Company Filings, Company Presentation

Our APV model utilized our EBITDA and equity only taxes estimates which were shown in Figure 6. Maintenance capital expenditures are forecast as a percentage of current GEO satellite PP&E which aligns with historical capex levels. Going forward, we have maintenance capex growing at roughly the pace of inflation. Upon the full completion of Lightspeed, maintenance capex will likely spike, which we have accounted for by estimating maintenance levels in 2031 and 2032 as a percentage of total satellite PP&E accounts. Historically, Telesat’s working capital accounts have been roughly -7% of revenues. In recent years there has been a significant deviation from this trend which is largely attributable to increases in prepaid expenses. We believe these changes in prepaid expenses are likely a result of investments in Lightspeed, which are anticipated to slow down in 2028 and conclude in 2030. As a result, we have forecast working capital accounts to sit at roughly current levels until Lightspeed is near completion, at which point accounts will slowly release and return to historical levels in 2032.

For a terminal value we have utilized a trailing twelve months EV/EBITDA exit multiple of 10x. It is difficult to build a case for how much demand may increase for Telesat’s services beyond 2032; there could be room for further explosive expansion, or growth may slow to low single digits on an annual basis. We believe that an exit multiple of 10x is roughly reflective of a company with TSAT’s margin profile and capex requirements which is growing in the mid-low single digits range per year (think Dye & Durham (TSX: DND), Enghouse Systems (TSX: ENGH) or Sylogist (TSX: SYZ)). In the case that TSAT is able to realize further growth beyond 2032, this multiple could feasibly exceed 20x EBITDA. We will expand on this thought in our sensitivity analysis.

Free cash flows to our hypothetical all equity firm are discounted at 9.1%. This is reflective of TSAT’s levered beta of 2.00, which we unlevered and applied a required return of 10% to. Our interest tax-shield value is discounted at 7.5%, which is reflective of the rate secured in the GoC financing agreement in September of 2024. The sum of our cash flows and interest tax-shield brings us to a current enterprise value of nearly $23B CAD. To arrive at an equity value, we add on current cash & equivalents and subtract our estimated peak debt level which will be reached between now and 2032. Although this is not technically reflective of what Telesat equity is worth at this moment, we believe using a peak debt level paints a better picture of what an equity holder should be willing to pay for shares in Telesat, as the dilutive effect of debt being taken on is inevitable and it will pull away from equity value on a constant enterprise value basis. Using this method, we arrive at an equity value of ~$17B CAD. Telesat Corporation is the GP in Telesat Partnership LP, with Telesat Partnership LP owning the remainder of Telesat subsidiaries which generate profits. Telesat Corporation owns 28% economic interest in Telesat Partnership LP, which means that the remainder of ownership is represented by non-controlling interests in the LP. To reflect this in our valuation, we could either subtract the non-controlling interests portion of equity value from our ~$17B, or we can split our ~$17B of total equity value across the total number of shares in both Telesat Corporation and Telesat Partnership LP. Both methods create the same ending share value, but we have selected the latter as we believe it is much simpler and intuitive given the fact that LP units are convertible to shares in Telesat Corporation. This also makes for less work when updating our model, as we don’t have to track the number of shares being converted.

In the end, our base case brings us to a share value of $316.42. This implies an 866% premium on Friday’s closing price of $32.76.

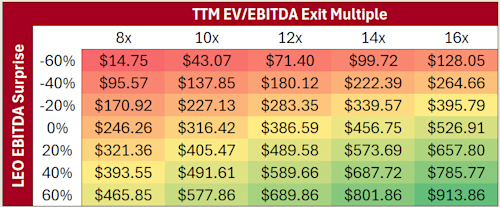

Sensitivity Analysis

As is standard in scenarios with high degrees of leverage and growth, our model is very sensitive to changes in inputs. All of our inputs have strong justification, however we could anticipate significant variance in two crucial inputs depending on how the demand picture for LEO services plays out. The first metric is our TTM EV/EBITDA exit multiple. We believe in 2032 that TSAT could trade at 8x EBITDA on the low end, which is representative of a high-margin and cash flow conversion business which is estimated to exhibit little to no growth going forward. This seems like a fair bottom end multiple, as the halt of growth in demand for LEO services is possible, but any less than this (decline in demand) is not reasonably foreseeable. On the high end, we believe that TSAT could trade in the high-teens to 20x EV/EBITDA range. This would be roughly representative of the company anticipating additional years of 20%+ growth, which we see as a foreseeable bull case given the demand drivers which are currently in place.

We also believe that it is important to analyze the effects of a partial failure in the Lightspeed project, or on the positive side the case where Telesat is currently underestimating future results. To do this, we have inserted a surprise factor into our model for EBITDA generated by Lightspeed LEO. In Figure 8 below, if our LEO surprise factor is -60% this means that the EBITDA generated from Lightspeed is 60% lower than current Telesat estimates imply. The effects of this not only are destructive to our estimated free cash flows, but also increase the peak debt levels required to finance Lightspeed, further diluting shareholder value.

Figure 8: Sensitivity Analysis – TTM EV/EBITDA Exit Multiple & Lightspeed EBITDA Surprise

Source: Phi Research

Only one of our analyzed scenarios implies a share price below Friday’s close of $32.76. We believe this table is a strong representation of all reasonably foreseeable scenarios and the message is clear; the likelihood that Telesat will be an incredible investment is very high.

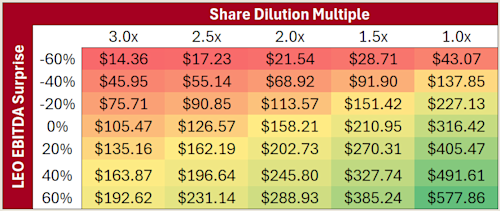

Another factor which we believe is worthy of analysis is share count dilution. Telesat provides a large amount of director and management compensation in the form of shares which over the course of 7 years (timeline of our model) could provide significant dilution. Additionally, Telesat could feasibly plug the holes on future financing requirements through equity issuances, price dependent, which could potentially serve as another source of significant dilution. Figure 9 shows our sensitivity analysis on share dilution and LEO EBITDA surprise. For context, a share dilution multiple of 3x simply implies that the share count used in our model is 3x more than current fully diluted levels.

Figure 9: Sensitivity Analysis – Share Dilution Multiple & Lightspeed EBITDA Surprise

Source: Phi Research

Note that the above is assuming the same exit multiple as was used in our base case of 10x TTM EBITDA. Once again, very few scenarios signal downside, with potential upside far exceeding these scenarios in both multitude and magnitude.

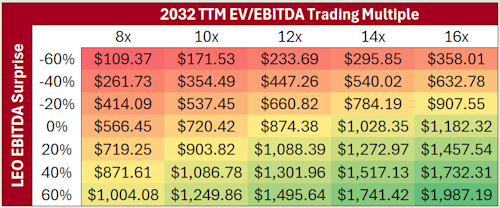

Multiples Valuation Demonstration

To paint a better picture of the generational opportunity which Telesat presents investors for growth, we will use a multiples valuations exercise on our 2032 estimated EBITDA levels. To arrive at an implied year-end 2032 share price, we multiply 2032 EBITDA by our model’s exit multiple, subtract 2032 debt levels, and add on 2032 cash balances. This creates an implied equity value, which we can then divide across current fully diluted share count. Our base case model, shown in detail in Figure 6 and Figure 7, implies that shares will be worth $720.42 at year-end 2032, representing a nearly 2100% gain from current prices. Figure 10 shows a sensitivity analysis on the implied share price for TSAT at year-end 2032:

Figure 10: Sensitivity Analysis - Year-end 2032 Multiples Valuation

Source: Phi Research

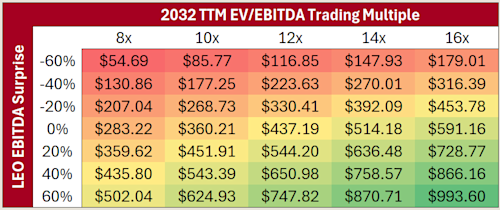

Even the most pessimistic scenario which we see as reasonably foreseeable is poised to return investors over 200% in the next 7 years. On the high end, returns potential is shockingly high. For further analysis, Figure 11 shows the same implied 2032 year-end share price sensitivity analysis, but under the assumption that share count doubles during the period.

Figure 11: Sensitivity Analysis - Year-end 2032 Multiples Valuation at 2x Share Dilution

Source: Phi Research

Even in the case where share count doubles, which we see as an unlikely level of dilution, TSAT shares offer an incredible investment opportunity regardless of the outcome analyzed.

Analysis of Risks

Although our valuation exercises proved the explosive upside present in shares of Telesat, it is not without undue risk. In our opinion there are two major uncertainties which are present; 1) execution of Lightspeed financial targets, and 2) requirements for debt refinancing and bankruptcy risks.

Execution of Lightspeed Financial Targets

If Telesat is not able to realize financial targets relating to Lightspeed, shares in the company could become virtually worthless. One of the main causes of failure in the project could be the loss of revenues to competition. Telesat is not the only company who has seen the growing opportunity for commercial deployment of an LEO constellation, with companies SpaceX and Eutelsat successfully having deployed networks, and Amazon’s Kuiper network currently undergoing launch processes. A handful of other GEO operators are also preparing for the execution of their own LEO networks, such as Viasat and Intelsat.

The unfortunate reality is that Phi Research does not possess the expertise to assess the competitive environment which is at play in the growing LEO environment. We do not have any experience in electrical engineering, aerospace engineering, software engineering, international law, or satellite operations, and the barrier to entry is very high. Despite this, there are a number of positive signals which give us confidence in the success of the Lightspeed project. The first is the competence of Telesat’s management and board; people who do have the ability to make a good judgement on the viability of the Lightspeed project, and the stakes which they are placing on the success of the project. Another positive signal is the performance of Telesat’s test LEO’s, LEO 1 and LEO 3, which performed on par with or above current terrestrial infrastructure and appears well positioned to deliver cutting edge services. A third positive signal is the barriers to entry which are present in the industry, which should provide a significant cushion against the commoditization of LEO services. Both the skilled labour & intelligence required to build and launch an LEO constellation provide incredibly high barriers to entry, not to mention the capital intensity of such projects and the requirements for financing. Lastly, we believe that the picture for growing demand for services is irrefutable and actually quite simple to understand, even for us non-engineers. Since the inception of the internet demand for services has only grown, and given the growing pace of technological advancements being made on Earth, the respective demands for connectivity which are created, and the shocking number of people globally who have no access to broadband in any format (2/3 people), it is difficult to build a case for a bear market ahead.

Financing Requirements and Bankruptcy Risks

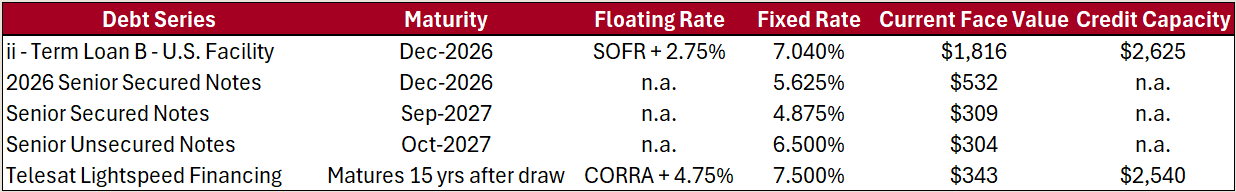

As it stands, we do not believe that Telesat has access to sufficient financing to fulfill capital expenditure obligations for the completion of Lightspeed. The inability to secure the financing required for completing the project could render equity virtually worthless, and without securing sufficient debt financing, it is reasonable to assume that dilutive equity issuances could be used to plug the holes.

Figure 12: Telesat Current Debt Stack (debt values in millions of CAD)

Source: Company Filings, Phi Research

Telesat’s current debt stack consists of a U.S. credit facility which expires in December of 2026, alongside three additional series of notes which expire from late 2026 to late 2027 and the GoC Lightspeed Financing. It will not be possible for Telesat to redeem all 2026 & 2027 debt at face value while also financing expenditures for the completion of Lightspeed. As a result, we believe that Telesat will renew its U.S. credit facility at a higher rate and with greater capacity, which we have included in our APV model and financial estimates. We believe the uncertainty surrounding the financing picture is the main catalyst which keeps shares from trading at or near their intrinsic value. Positive developments could arise in the near term and in our opinion will be the primary driver of the direction of share prices in the next 1-3 years.

Additional risks surrounding financing present themselves in the form of covenant compliance and the possibility of bankruptcy. Either of the above could result in a recapitalization which once again would almost entirely erase the value of shares. In late 2027 we anticipate that Telesat’s interest payments will exceed free cash flows produced by its GEO business, meaning the successful launch and commercialization of Lightspeed in 2028 is a make or break for the value of shares.

Summary and Investment Decision

The future of Telesat is surrounded by a multitude of uncertainties, but one thing which is undeniable is the potential for gains. The risks may be high, but the growing demand for LEO services, the competence and investment of management and board members, and the progress and results of LEO tests which have been done give us a significant amount of confidence in Telesat realizing a positive outcome from current initiatives.

The intelligent investor knows that predicting the future with a high degree of certainty is usually a fool’s game. Good investments are simply those where the positive outcomes are much larger or much more likely than negative outcomes; we believe this is the case with Telesat. On a balance of probabilities, shares should triple, quadruple, or truly go into orbit. Strong Buy.