Top Down Analysis – Banking on Consolidation: Kiwetinohk Energy Corp. - (TSX: KEC)

Published on 2025-06-16

Future growth of North American liquefied natural gas exports have been a significant driver of an uptick in drilling activity and mergers & acquisitions in Canada’s Montney and Duvernay formations. These formations boast some of the largest natural gas reserves found globally which have been exploited only to a small extent, creating significant opportunities for accretive acquisitions in the space. Expected synergies from consolidation of land ownership and associated assets coupled with a strong backstop of growing export capacity and low costs of financing are expected to create significant tailwinds for further consolidation activity. For a small cap investor, the dream of a 50%+ takeover premium does not seem so distant. As a top pick to play on the theme, and an attractive standalone investment, we have selected Kiwetinohk Energy Corp. (TSX: KEC).

The Montney and Duvernay formations are located in Northwestern Alberta and Northeastern British Columbia, with the Montney being the larger and higher impact of the two. Both of the plays exhibit high weightings of natural gas reserves relative to oil, with the Duvernay being very rich in natural gas liquids and the Montney being drier in comparison. Wells drilled in the area are very capital intensive, as reserves are found deep underground and require exceptionally long well lateral lengths and frac intensity to optimize economics. The cost of a single well in the area is roughly $8M-$12M, dependent upon well design nuances and tie-in costs which vary based upon geographic location. Figure 1 shows the geographic positioning of the Montney formation:

Figure 1: The Montney Formation

Source: CBC

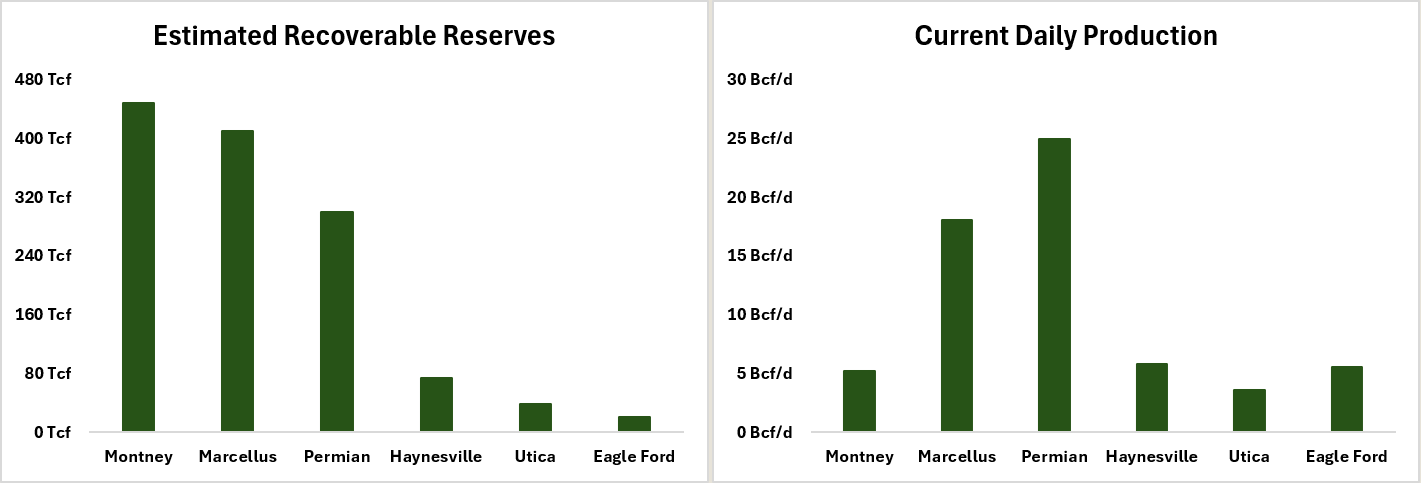

The Montney alone is estimated to have nearly 450 trillion cubic feet of natural gas reserves. This is significantly larger than other large basins like the Permian and the Marcellus shale, with the Montney dwarfing other prominent natural gas shale plays like the Eagle Ford and Haynesville. In contrast to other large gas reserves, the Montney has not been exploited to a great extent and is in the “first inning” of its development. Figure 2 shows estimated gas reserves and current production levels for other large North American natural gas plays. The takeaway here is that the Montney offers a long runway of economical drilling activity in comparison to other North American natural gas reserves.

Figure 2: Estimated Reserves vs. Production

Source: Phi Research, EIA, Enverus, CBC

The Liquified Natural Gas Opportunity

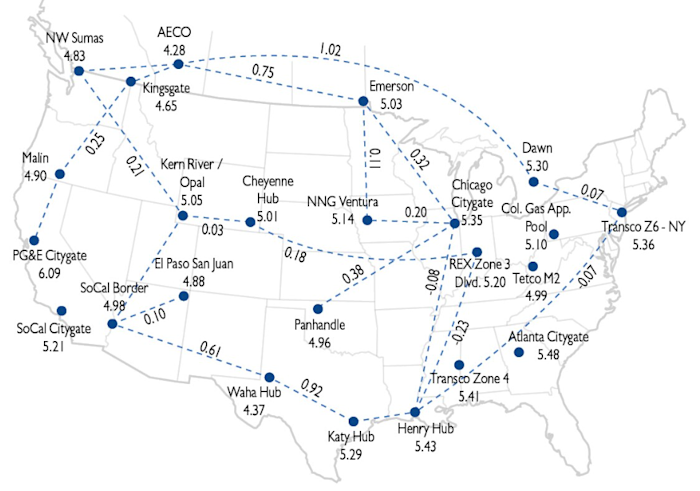

The end markets of natural gas produced in the Montney are largely within North America, with pipeline networks transporting the gas from wellsite to nearby processing facilities, and from processing facilities to major distribution hubs. Each distribution hub has a unique market for gas, each with its own pricing and demand cycles. Figure 3 shows distribution hubs across North America. Notable hubs in Western Canada are Alberta’s AECO hub and Station 2 in Northern British Columbia.

Figure 3: North American Natural Gas Distribution Hubs

Source: Energy Intelligence

Pricing at distribution hubs is generally inversely correlated to gas supply, and positively correlated with proximity to gas demand (major cities). Hubs with LNG export capacity will also offer higher pricing, as gas may be exported to international markets who are willing to pay more for less. Supply is based upon geographic positioning of gas producers and pipelines which connect their product to different markets. In general, pricing at Canada’s AECO and Station 2 hubs is lower than pricing in the United States, largely attributable to the infrastructure which transports Canadian product to the United States and a complete lack Canadian LNG export capacity.

The export of natural gas to other nations by sea is a complicated process, however the results can be very profitable. In contrast to Western Canadian gas prices, which usually fall within the $1-$3 CAD per GJ range, prices in markets who cannot support their own demand with local drilling are much higher. One key Asian market with a growing demand for natural gas is Japan, with current pricing for liquefied natural gas sitting at ~$16.75 CAD, a massive premium to current AECO pricing of ~$1.40 CAD. A large number of Asian nations have a growing demand for natural gas, driven by the low emissions nature of gas, its high levels of efficiency for power generation, and, supply dependent, its low cost.

As previously stated, the cost of exporting natural gas internationally is a complicated and capital-intensive process. For Montney gas to reach an Asian market, the gas is first extracted from the wellhead, after which it is sent to a nearby gas processing plant. Once processed, gas will be transported to larger pipelines which move the product from Northeastern B.C. to a coastal liquified natural gas facility (none of which are yet operational in British Columbia). Natural gas liquefication facilities are extremely expensive and long-term projects to be undertaken. Once gas has reached such facilities, the gas will be supercooled and pressurized, reducing its volume by ~600x, at which point it is ready to be loaded onto a tanker and sent to sea. Figure 4 shows a liquefied natural gas tanker:

Figure 4: Liquified Natural Gas Tanker at Sea

Source: The Globe and Mail

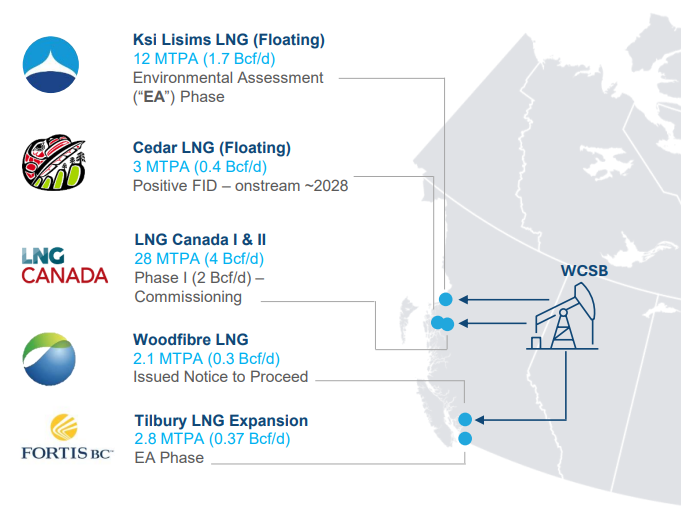

The United States currently has ~12-13 Bcf/d of LNG export capacity. This is a sharp contrast to Canada, with our first terminal, LNG Canada, preparing for its first shipment this summer and flowing at 2 Bcf/d upon startup. The project is a joint venture between Shell, Petronas (Malaysian national energy corporation), PetroChina, Mitsubishi Corporation, and KOGAS (Korea Gas). Unsurprisingly, the large majority of export volumes have been committed to the JV partners, all of which are either operating in underserved markets or who, in the case of Shell, have a global footprint in LNG marketing. LNG Canada is a two-phase project, with the second phase providing an additional 2 Bcf/d in volumes once completed. Phase 2 has not reached a final investment decision; however the prospect of the project being executed is very high, with expected completion in 2030. Despite being a laggard in developing export facilities in comparison to the United States, Canada has a number of other LNG projects which are awaiting a final investment decision, near regulatory approval, or currently under construction. Additional projects have been proposed at a high level, including the construction of pipelines to Churchill, Manitoba, with a matching LNG export facility set to service underserved European markets, as well as potential projects exporting from the East Coast of Canada. Currently projects to the east are only rumour, however, there has been a clear shift in narrative in accordance with the change in Canadian federal government; Canada is no longer afraid to do what is best for its economy. Figure 5 shows the state of Canadian LNG export terminal development:

Figure 5: The State of Canadian LNG

Source: Birchcliff Energy

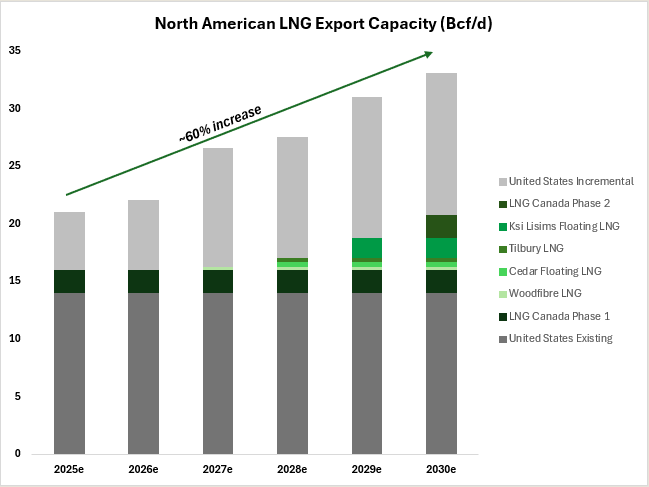

The United States is also preparing and constructing additional LNG export capabilities. The majority of projects will be stationed in the Gulf of Mexico, with one project approved and awaiting construction in Southern Alaska, set to service the Prudhoe Bay area. Over the course of the next five years, North American LNG export capabilities are set to rise by over 60%. Expected 2030 LNG export volumes from North America will represent ~25% of current combined natural gas demand between Canada and the United States. A ~25% increase in accessible demand provides a significant backstop for North American pricing environments, especially as overseas markets willing to pay a higher price will take priority over domestic demand. In Canada, total 2030e export volumes of ~7 Bcf/d represent nearly 60% of current Canadian demand of ~12 Bcf/d. The significance of this for North American gas producers is likely more stable and potentially higher local pricing environments. The benefits from access to overseas markets will spread not only to larger producers with access to export facilities, but also to smaller producers who only distribute gas locally. Figure 6 shows the expected changes in export capabilities of LNG in North America:

Figure 6: Pro Forma North American LNG Export Capabilities

Source: Phi Research, United States Department of Energy, Canada Energy Regulator

Additional Broad Scale Drivers of Consolidation

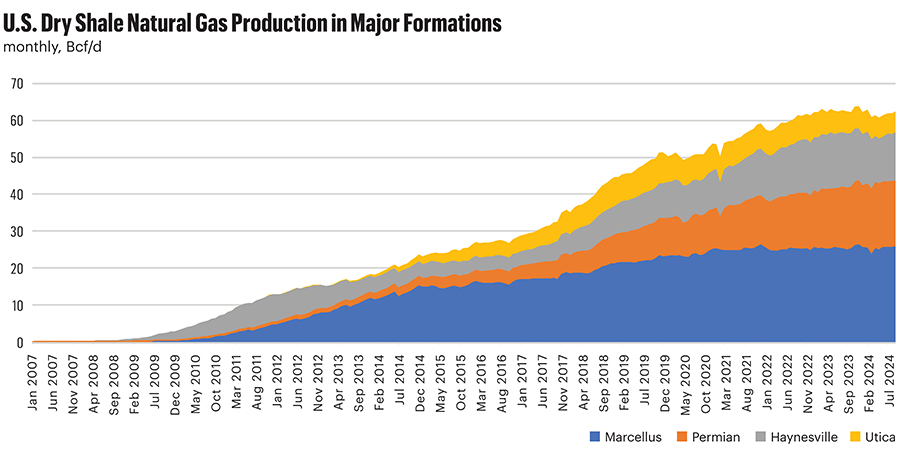

Based on estimates from Shell, global demand for LNG is expected to rise ~60% by 2040. With production in the Marcellus having reached a plateau and peak levels of Permian production within sight, it is reasonable to assume that Canadian natural gas will fill the majority of the gaps in future production with its unmatched reserves (see Figure 2). Figure 7 shows the plateau of total natural gas production across major plays in the United States:

Figure 7: United States Natural Gas Production

Source: Hart Energy

Greater production levels drives greater synergy potential from consolidation. Considering the extensive runway for global gas demand and future Montney development, the trend of consolidation is one which will continue for the long term.

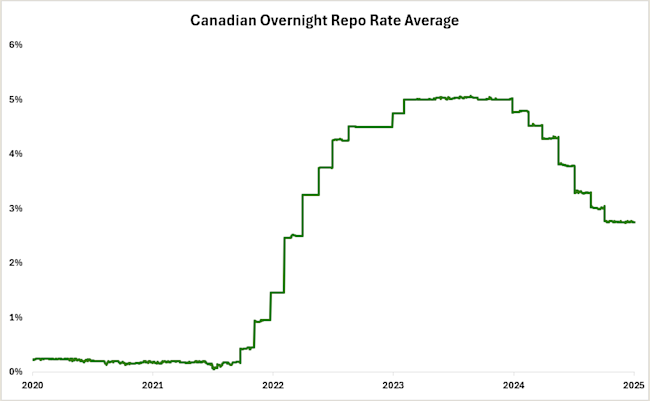

On June 3rd, 2025, ARC Resources Ltd. (TSX: ARX) announced the issuance of a series of senior unsecured notes. ARC’s intention is to use the proceeds from the issuance to finance its purchase of a series of Montney assets from Strathcona Resources Ltd. Between the two series of notes issued (total offering of $1B CAD), ARC secured a weighted cost of debt of 3.95%, an unprecedented rate for oil & gas production companies. Smaller comparable companies often pay upwards of 10%-12% annual interest on debt, which demonstrates the power of market cap in securing low costs of capital. In general, Canadian lending rates are low, with the expectation being for further decreases in prime rates to come. Figure 8 shows the Canadian Overnight Repo Rate Average over the last five years:

Figure 8: Canadian Overnight Repo Rate Average

Source: Bank of Canada

Interest rates are the grease that spins the cogs of mergers & acquisition activity. With rates sitting at attractive levels and likely only improving for the foreseeable future, the stage is once again set for consolidation activity.

Value Creation from Consolidation

The consolidation of operations in the oil & gas industry provides for a large number of synergies. The nature of Montney operations is such that a number of these synergies are amplified, and regardless of the macroeconomic backdrop it is and will continue to be possible for larger players to create value through mergers & acquisitions.

Development Timeline

From a present value perspective, time is money. The sooner that cash flows can be realized, the sooner they can be reinvested for further gains, and the less risk is associated with them. These effects are amplified in the oil & gas sector where cash flows are discounted at a very high rate. Small exploration and production companies frequently lack the financial flexibility to optimize their operations and to drill as many wells as they desire. As shown in ARC Resources recent debt issuance, market cap can be a significant factor in securing low costs of financing. Additionally, a company with a market cap of $100B can much more feasibly finance a ten well Montney program with equity than one with a $1B market cap, for whom the same ten well program would be an equivalent amount of spending to 10% of their market cap. In short, larger company’s access to cheaper debt, higher volumes of equity, and amplified annual cash flow generation can allow them to extract the resource at a much higher pace and create value for a neutral shareholder.

Drilling, Completion, Equipment and Tie-in (DCET)

The costs of creating a well which is able to successfully extract the targeted resources from the ground are extremely high. As previously stated, the total DCET costs for a well in the Montney are roughly $8M-$12M. With their superior access to capital, larger producers are able to place more wells on the same drilling pad. For an equivalent number of wells, this decreases the costs of drilling lease rentals, fuel supply to service companies, and, most importantly, the costs of preparing leases for drilling. Additional synergies could be realized in equipment and tie-in costs as more wells on a single pad can share processing and egress infrastructure. Figure 9 shows a multi well pad being drilled in the Montney:

Figure 9: Multi Well Pad

Source: CBC

Resource Egress

Gas production must flow to processing facilities before being sent to market, however such facilities are a significant capital investment. Larger producers own their own processing facilities and will rent excess capacity to smaller producers. As a result, the costs of processing gas and preparing it to be sent to market are significantly higher for smaller producers. Even smaller producers who own their own egress and processing infrastructure are unable to optimize the operations of such assets. Consequently, a corporation who does not own sufficient egress infrastructure will be significantly more valuable if owned by a corporation who does (and has the ability to construct more).

Risk-Reward of Drilling

Diversification is key to reducing the risk-reward proposition created by operations. A smaller corporation takes on significantly more risk than a larger one for an equivalent sized project. In the example of a company with a $1B market cap, a ten well drilling program would equate to roughly 10% of their market cap. In contrast, the same ten well program could produce zero gas and it would have little impact on a company like Canadian Natural Resources’ financial standing. From a lender’s perspective, asset diversification also makes for a more attractive investment, which ties back in to larger producers having greater access to cheaper financing.

Gas Market Access

Larger corporations have access to a much broader array of natural gas markets. Alternative gas markets can offer stronger pricing on a consistent basis, and a diversified portfolio of end markets allows a corporation to select the one which is offering the best pricing on an ad hoc basis. In Tourmaline’s acquisition of Crew Energy, the company cited their access to California gas markets as a significant driver of value creation for the transaction. The same synergies would apply to almost any other potential acquisition target. Additionally, larger players have greater access to both current and prospective LNG export facilities.

Target Selection

With the stage set and the justification clear for consolidation activities, we must create a set of criteria for how to play on these themes. Although there is a strong case for most junior and mid-cap Montney producers to be purchased, the reality is that large corporate transactions are still relatively infrequent. As a result, we will only select an investment which is attractive without the background of industry consolidation trends. Our selection criteria is as follows:

Attractive to the Acquirer. Our selection must be of a reasonable size to be acquired, have significant exploitable synergies available, and be attractively valued to leave room for a large takeover premium.

Willingness to Solicit a Sale. Pride and the desire to retain salary interminably often causes management teams and boards to act outside of the best interest of shareholders. Behaviour preventing a takeover transaction is a prime example of this. Our target must have the incentives in place for a transaction to occur, and ideally will have made signals soliciting a sale.

Attractive Standalone Investment. A takeout is a low probability, high payout event. In the case that it does not occur, we still want to own an investment where the upside outweighs the downside. Here, we look for quality assets, a quality corporate governance scene, and an attractive valuation.

Kiwetinohk Energy Corp. – (TSX: KEC)

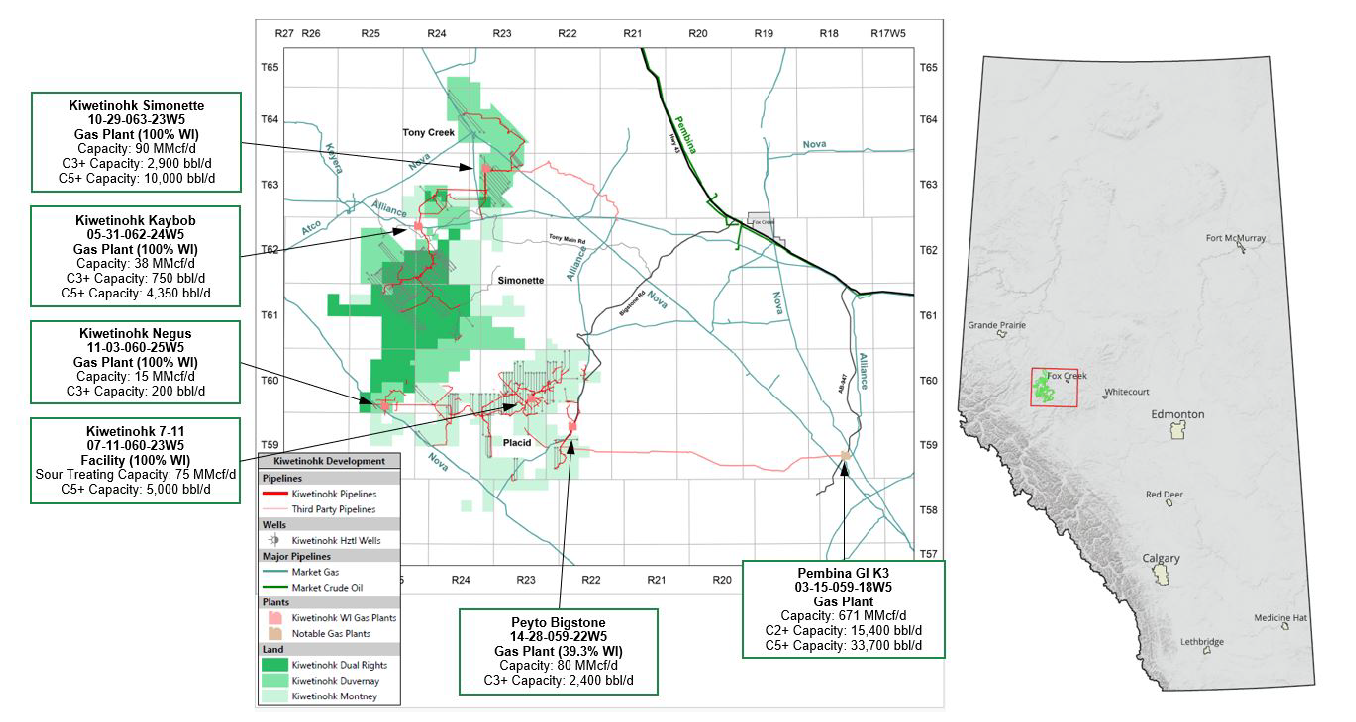

Our analysis leads us to one attractive target: Kiwetinohk Energy Corp. Kiwetinohk is a small exploration and production company in the Alberta Montney and Duvernay. The company’s land is located west of Fox Creek, Alberta, in the Simonette and Placid areas. The company uses a mix of wholly owned and third-party egress infrastructure. Figure 10 shows a summary of KEC’s upstream operations:

Figure 10: Kiwetinohk Upstream Operations

Source: Company Filings

In addition to its upstream operations, KEC owns the rights to six power development projects. Projects range in size from 124MW to 500MW, with solar and natural gas as proposed sources of power. As it stands, no power projects have reached a final investment decision and the only value in them comes via their positioning in regulatory queues. The power business is not a priority to KEC’s operations, and the company’s focus is on divesting or potentially securing third party financing for projects.

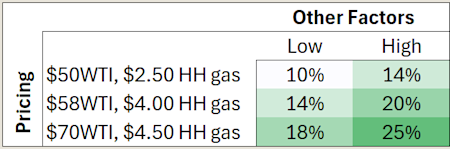

Attractive Standalone Investment

Kiwetinohk produces significantly more cash flows than any of its peers on a relative basis. At strip pricing, the company is expected to yield roughly 15%-25% free cash flow this calendar year. All else constant, this implies an investment which pays for itself within a 4-7 year timeframe, a tremendous proposition when compared to peers who are yielding high single digits free cash flow. Figure 11 shows KEC’s 2025e free cash flow yield sensitivity analysis. Even in a worst-case scenario, KEC is yielding 10% free cash flow which is in line with the industry cost of capital. This implies the downside on KEC is an adequately valued asset (assuming zero future growth), even at a pricing level which appears to be highly unlikely.

Figure 11: Kiwetinohk 2025e Free Cash Flow Yield Sensitivity

Source: Phi Research, Company Filings

Since its inception, the entirety of Kiwetinohk’s free cash flows have been put towards production growth. The long-term goal has been 40.0 Mboe/d in production, which is roughly the capacity of their current egress infrastructure. Production has grown at ~25% per year since 2021 and is expected to be 32.5 Mboe/d this calendar year. Based on current growth, the company expects to reach their target of 40.0 Mboe/d by the end of 2026, at which point the company can reinvest in more egress infrastructure or begin actively returning capital to shareholders. Figure 12 shows KEC’s current valuation metrics relative to Montney and Duvernay peers and precedent transactions:

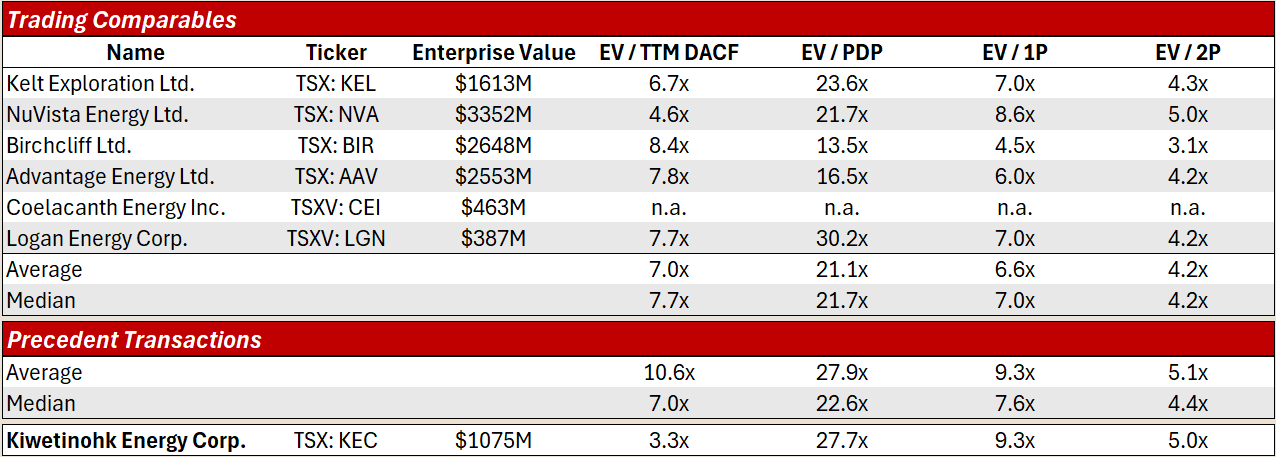

Figure 12: Relative Valuation

Source: Phi Research, Company Filings

On an EV/DACF basis, Kiwetinohk trades at a heavy discount relative to its peers. The typical argument of the “small-cap discount” is invalid in this case, since if KEC were to trade in line with the peer group average it would have an enterprise value greater than $2B. LGN and CEI’s high valuations also combat this theory (CEI currently produces zero DACF). Surprisingly, the company trades above peers on and EV/PDP basis, which we think is largely attributable to the production growth which the company has already realized since its last reserves report and the continuing growth which is expected throughout the year.

We believe that the most likely explanation for KEC’s discounted value of cash flows relative to peers stems from their uses of cash flows. Companies who have a focus on share buybacks, dividends, and paying down debt like Birchcliff and Advantage trade at the highest multiples in the peer group. On the contrary, NuVista and Kelt Exploration have been growing production volumes between 40%-50% per annum as of late. In recent years orientation towards production growth has fallen out of favour with investors, due to the risks associated with pricing environments and the multitude of companies who have fallen flat on their face pursuing this plan. Instead, the new trend is to keep production levels flat and return capital to shareholders in a high proportion. We believe our report builds a solid case for the stability of future gas pricing, the question is whether we trust the Kiwetinohk management team to make the right decisions on drilling with our money. Analysis of corporate governance practices can provide us with an answer.

Kiwetinohk’s board of directors consists of ten individuals, an appropriate number for a company of this size. Excluding the two seats held by ARC Financial (major institutional shareholder), the board is 90% independent. Pat Carlson, CEO of KEC, holds a seat as a director but not as chair, which we see as a positive. All ten board members have exceptional levels of relevant experience, and we see no holes in their collective qualifications or competence. Full board member profiles can be found on the KEC website (link).

Both board members and executives follow share ownership programs, with CEO ownership minimums set at 3.0x annual salary and 1.5x for other executives. Roughly 75% of executive pay is performance based, and ~50% of compensation is share based. The company employs the use of a base salary (~25% of compensation), short term cash bonuses, restricted shares units, options, warrants, and other shared-based awards, along with a clawback policy to prevent any manipulative activities. Overall, the incentives are in place for management to act within the best interests of shareholders.

Along with management competence and alignment with shareholders, Kiwetinohk boasts strong well results, further driving the value proposition for production growth. On an IP180 Sales Rate basis, KEC has brought on stream 8 of the top 10 performing wells drilled in the Duvernay, and 40 of the top 100. This implies the company is sitting on a high-quality asset which is worthy of further development.

As a standalone investment we view Kiwetinohk as a Buy. The shares are very attractively valued relative to peers and the free cash flow generation is very strong. Based on the quality of the wells drilled thus far, the incentives in place for the individuals allocating capital and their competence, and the feasibility of consistently friendlier pricing environments, we are very comfortable with the plans for production growth. By the end of 2026, the company should be producing 40.0 Mboe/d and beginning to pay down debt and buy back stock, securing itself a much stronger valuation on and EV/DACF basis (assuming it is not acquired before then).

Attractive to the Acquirer

Kiwetinohk has an enterprise value of just over $1B CAD, making it an attractively sized target for a corporate takeover. Due to their size, Kiwetinohk has a multitude of exploitable synergies from the perspective of resource extraction timelines, DCET costs, risk-reward of drilling, and resource egress. KEC also has access to significantly fewer natural gas end markets than larger players. From a valuation perspective, Kiwetinohk trades far below the peer group on an EV/DACF basis, as well as far below the average of precedent transactions, creating plenty of space for a takeover premium. Our discussion of the company’s value proposition as a standalone investment is applicable to a corporate buyer as well, and the valuation is even more attractive for a buyer who can create additional value through synergies.

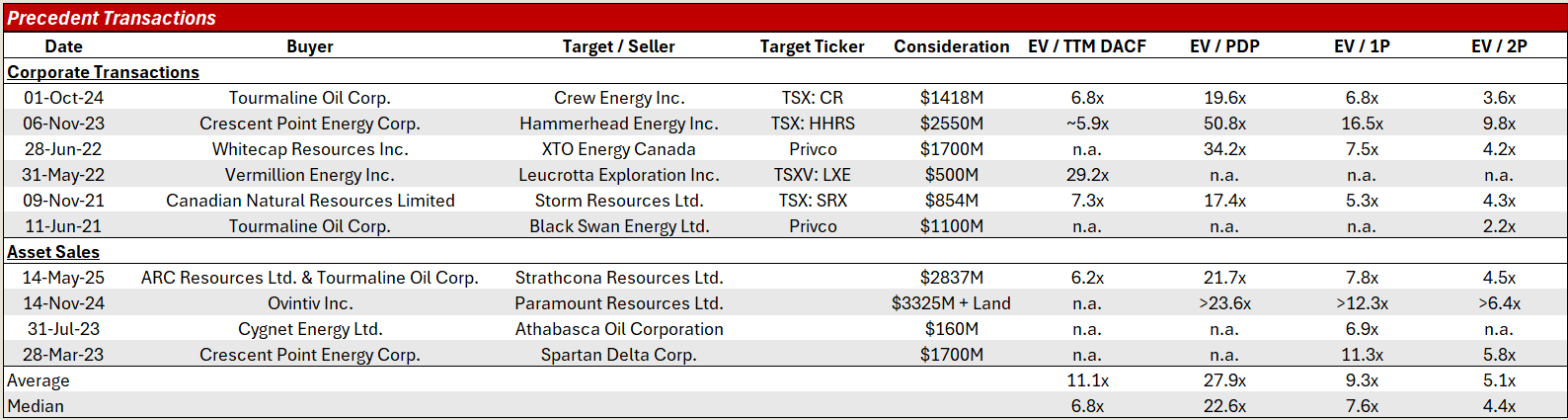

Figure 13: Precedent Transactions

Source: Phi Research, Company Filings

Figure 13 shows a variety of precedent Montney and Duvernay transactions; both corporate takeover transactions and asset sales. Information is not perfectly complete however all estimated metrics included provide a more conservative view of the multiple paid than the true metrics would. For HHRS we estimated TTM DACF as a run rate of the trailing 9 months DACF, since financials were not available for the entire trailing 12 months period. For Paramount Resources’ sale of their Montney assets, Paramount received both ~$3.3B in cash as well as a variety of Horn River and Liard basin lands from Ovintiv. Our calculations do not include the value of these lands, as it was not disclosed, meaning that the true multiple paid to Paramount was higher than the values shown. Based on the total development level of KEC’s lands and their current strategic objectives, we think the Crescent Point acquisition of Hammerhead Energy provides the strongest precedent for the valuation which KEC could be assigned under a larger strategic buyer. Overall, the prices paid in precedent transactions is a strong testament to the value which could be created through an acquisition and be shared with Kiwetinohk’s current shareholders.

Willingness to Solicit a Sale

On May 7th, 2025, Kiwetinohk stated that they have employed both National Bank Financial and RBC Capital Markets to assist in conducting a strategic review of KEC’s operations. The Q1-2025 press release stated that the company would evaluate a range of value enhancing activities, including a partial or total sale of the company, a strategic merger, or other opportunities as they may be identified. Formations of strategic committees, especially those which seek to explore the sale of a corporation, are often a very strong indicator that a corporate sale is imminent. Kiwetinohk is your investment banker’s favourite energy stock, and it is ours as well.

The power project sector could potentially be seen as an overhang to buyers of KEC, as the projects do not benefit from any synergies and may not align with the strategic initiatives of buyers. Over the past 12 months or so, Kiwetinohk has had a notable change in tone surrounding its power segment, shifting away from a focus on development towards a focus on divestment. In Q1-2025, KEC divested rights to its Opal Natural Gas-Fired power plant for proceeds of $21M. We believe the sale of this asset, along with managements comments in regards to future divestment plans signal the preparation for a potential corporate sale.

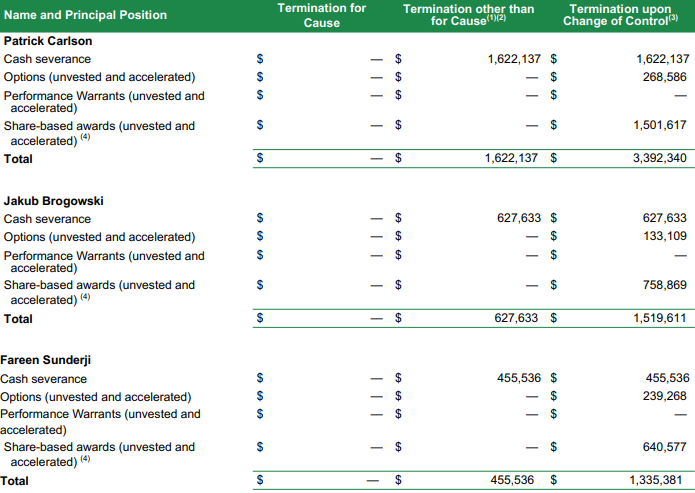

Apart from having taken actions which signal a potential sale, we want our board and management team to have strong incentives in place to follow through with a sale, rather than protecting their positions and retaining their salaries until a hostile bidder comes along (or no bidder, ever). Board and executive ownership plans are a great starting point, as a takeover premium provides a large payout on shares owned. Additionally, management's high levels of share-based compensation and low fixed salary put the required incentives in place. In the case that management is removed upon a change of control, KEC executives are required to be paid out high-value severance packages. Figure 14 shows a summary of Kiwetinohk’s executive termination payments:

Figure 14: Kiwetinohk Termination Payment Summary

Source: Company Filings

CEO Pat Carlson is poised to receive ~$3.4M in the case of termination via change of control. Combined with a 50% takeover premium on his current share ownership of 1 million shares, and there is a nearly $15M incentive for Carlson to execute a corporate sale. A $15M payout would be roughly 30x Carlson’s annual base salary and ~8x his total compensation received last year. This is a strong incentive for executing a sale. Although the above shown termination payments are high-value, they would not be a deterrent to a corporate buyer in a transaction that would be worth between $1.5B-$2.5B.

Potential Overhangs

ARC Financial Ownership

ARC Financial is a Calgary, Alberta, based private equity firm. ARC owns just under 63% of Kiwetinohk’s issued and outstanding shares, meaning the firm has a significant say in a possible takeover transaction. ARC also controls two seats on the Kiwetinohk board of directors. As much as it should not play a role in ARC’s decision-making process, we think the past performance of their position in KEC does indeed have an effect on ARC’s willingness to sell. As of today’s close of $18.60, shares have increased ~50% in value since first listing in 2022. This marks a significant win for ARC and we believe increases their likelihood to sell. In the case that ARC would not be satisfied with the returns stemming from a 3rd party takeover bid, ARC would in turn view the shares as an extremely attractive investment at current prices and could potentially launch their own bid for the remaining outstanding shares. ARC likely has ample liquidity to execute a takeover bid after the failure of their bid for STEP Energy Services in December of 2024.

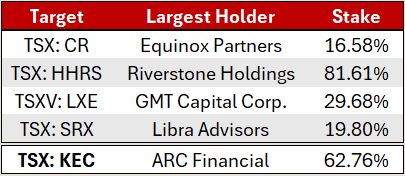

Figure 15: Precedent Transaction Institutional Holders

Source: Bloomberg

Figure 15 shows the largest institutional holders in each of our analyzed public company precedent transactions. All four companies purchased had large institutional holders, with Riverstone Holdings position in Hammerhead Energy being notably large at over 80% of shares. In summary, we do believe that ARC’s large ownership in KEC does pose a potential risk to the completion of a successful corporate sale. Despite this, our precedent transactions show the possibility for a transaction is real regardless of institutional ownership stakes and that in the case where ARC is not satisfied with a takeover premium, by that same logic, they should purchase the remaining shares outstanding with their own capital.

Kiwetinohk Power Development Projects

Kiwetinohk’s power development projects pose a risk to potential takeover bids due to the low likelihood that these projects are strategically aligned with the operations of buyers. None of KEC’s power development projects have reached a final investment decision, and thusly their only value stems from their positioning in regulatory queue’s. Unfortunately this means that there is no potential for a spin-off as part of a transaction, but ultimately the fair value of these projects is relatively low, which decreases the risk of them obstructing a takeover bid. As we touched on before, Kiwetinohk is focused on divesting the majority of these assets, with the sale of their Opal project executed in Q1 of this year for proceeds of $21M. If the company can continue to divest these assets or secure third-party financing as planned, the likelihood of these projects getting in the way of potential takeover bids decreases significantly.

Summary and Investment Decision

The Canadian energy market is often a bleak space, however, after a decade of disappointment, it seems there may finally be reasons to be optimistic. Kiwetinohk offers investors a unique way to expose themselves to positive trends in Canadian energy. On the downside we do not see the company underperforming the peer group, and although far from a guarantee, the chance of securing a large takeover premium is very real. On a balance of probabilities the shares will outperform significantly. For investors willing to accept the broad market risks of Canadian oil & gas, shares are a Strong Buy.